A credit score bureau is a corporation that aggregates information on particular person customers and sells that information to lenders. These bureaus permit potential lenders perception into the creditworthiness of a possible debtor.

Credit score bureaus collect info from a big selection of sources. Totally different monetary establishments report information to credit score bureaus. These primarily embody banks and credit score unions however lengthen to auto lenders, bank card issuers, and on-line lenders. Moreover, credit score bureaus discover different obtainable public information starting from court docket orders to property information.

The main credit score bureaus in the US are Equifax, Experian, and TransUnion. Every of those organizations calculates credit score studies barely in a different way, that means it is common to get various outcomes from the completely different bureaus. Many potential lenders use a mean of the three scores to get essentially the most holistic understanding doable.

Whereas this may increasingly appear complicated, the excellent news is that each one three bureaus are in search of related patterns after they analyze your credit score historical past. For instance, they need to see on-time funds, a wholesome credit score combine, and low utilization in your strains of credit score.

This text will cowl the fundamentals of how credit score bureaus work, why they’re important, and what’s their main operate.

Why are Credit score Bureaus Essential?

Lenders should rigorously contemplate credit score danger when deciding whether or not or to not lend cash to a person shopper. Lenders which are too lax with their necessities danger handing out funds that aren’t repaid, which is problematic for the group. However, lenders which are rigid with funds miss alternatives and lose potential purchasers.

Placing the proper steadiness is, subsequently, a vital process. Particular, unbiased information aggregation and reporting turn out to be immensely precious. Credit score scores present goal metrics by which lenders could make selections.

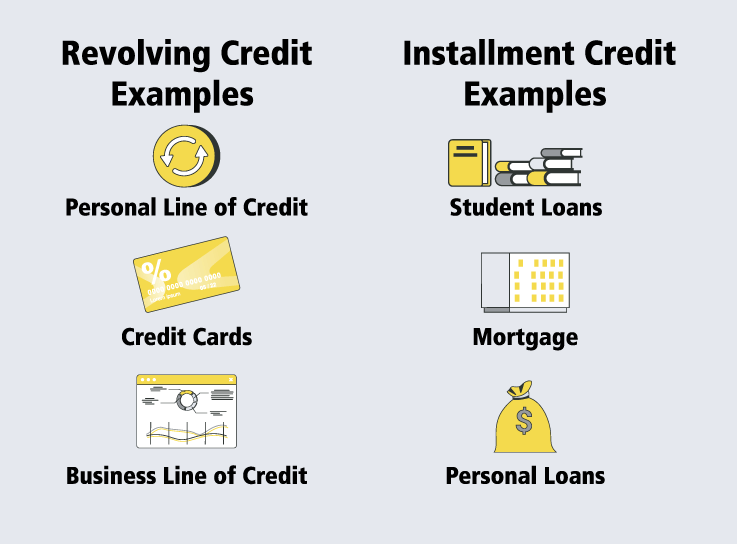

What are these metrics, precisely? Lenders (and, by extension, credit score bureaus) are wanting to see that you’re not using a dangerously excessive share of your present credit score. They need to know that you’re paying all of your payments on time. They usually need to see that you’ve got maintained a wholesome combination of account varieties over a protracted interval.

It is value noting that shopper reporting companies don’t grant or deny loans. As a substitute, they calculate creditworthiness utilizing fee historical past and credit score info. Most lenders take into consideration a variety of things. Typically elements equivalent to earnings, financial savings, and present money owed can play an much more vital position than credit score scores in these lending selections. Nonetheless, credit score scores are a typical affect on lending selections.

How Does a Credit score Bureau Work?

Credit score bureaus obtain studies from varied establishments that permit them to construct a complete portrait of any particular person shopper’s monetary accounts. Utilizing quite a lot of elements present in your credit score historical past, these establishments calculate an general credit score rating, primarily starting from 300 to 850. The relative worth of every rating can fluctuate relying on the company reporting and the lender’s standards. Nonetheless, as a normal rule:

300 to 499 is taken into account Very Dangerous

500 to 600 is taken into account Poor

601 to 660 is taken into account Honest

661 to 780 is taken into account Good

781 to 850 is taken into account Wonderful

As we are going to focus on later on this article, your precise rating can rely on which bureau you ask. It could additionally rely on elements such because the circumstance wherein you’re making use of for credit score. FICO will calculate a barely completely different worth in your rating based mostly on private parts, equivalent to what kind of asset or mortgage you are trying to get.

What are the Three Most important Credit score Bureaus?

As famous within the introduction, the three essential credit score bureaus within the USA are Experian, Equifax, and TransUnion. These firms coordinate with lenders throughout the nation to assemble and manage an up-to-date database containing info on the credit score historical past of thousands and thousands of People. This info empowers firms to know the dangers related to any mortgage they might contemplate giving. It additionally permits customers to benefit from credit score by constructing a optimistic rating. (Although if you don’t at present have a superb credit score rating, low credit score choices can be found for you, too.)

Which Credit score Bureau is Most Typically Used?

Of the three essential credit score bureaus, Experian is the most important. Nonetheless, Equifax and TransUnion are incessantly used and vital credit score bureaus. It would be best to control all three main credit score reporting companies to trace your credit score rating and monitor the studies for errors. Collectively, these three bureaus are essentially the most used and best-recognized companies in the US. And almost any kind of mortgage you attempt to get will take your studies from these companies into consideration a method or one other.

What Does a Credit score Bureau Do?

Establishments equivalent to Experian, Equifax, and Transunion are information collectors. They coordinate with banks, credit score unions, and different lending establishments whereas researching publicly obtainable info to type monetary overviews of particular person customers.

Credit score Bureaus then promote that info to potential lenders who need to make educated decisions relating to how a lot cash they lend to any particular person. (And whom they need to not lend to within the first place.)

What Info is Collected by Credit score Bureaus?

Just a few items of knowledge recurrently analyzed by credit score bureaus embody:

- Cost historical past

- Account balances

- Account open dates

- Date of the final exercise

- Excessive credit score on an account

- The credit score restrict on every account

Companies equivalent to Equifax additionally accumulate info on debt collections and bankruptcies.

How Does the Credit score Bureau Get Info?

Credit score bureaus have prepared entry to info in your monetary accounts as a result of lenders readily share that information. Lenders voluntarily adjust to these requests as a result of the credit score bureaus have a longstanding repute and since lenders depend on the credit score studies that Bureaus obtain.

Information relating to on-time funds, account balances, and so forth., then get aggregated right into a remaining rating based mostly on all this info. FICO and VantageScore are the most typical scoring methods, which have slowly converged into more and more related algorithms. Each methods now weigh customers on a scale of 300 (Low) to 850 (Excessive) by way of credit score scores.

Why Do I Get Totally different Credit score Scores for Every Bureau?

Some customers want clarification after they first examine their scores and see that completely different bureaus have completely different scores. Chill out: it is a widespread incidence. This will occur for a number of causes.

- Totally different bureaus could maintain completely different schedules for accumulating and aggregating info, that means they base your scores on barely completely different home windows of time.

- Some lenders could report to at least one or two credit score bureaus, whereas others report back to all three.

- Bureaus can use completely different scoring fashions which calculate your rating a little bit in a different way.

Along with variations between bureaus, completely different lenders may additionally use barely completely different standards. FICO, for instance, affords many distinct fashions for evaluating creditworthiness. They could present a rating for auto lending and place extra significance on somebody’s auto fee historical past over their on-time bank card invoice funds, for instance.

Discrepancies between bureaus are sometimes no trigger for concern. Nonetheless, this subject does underscore the significance of conserving tabs in your credit score studies. By taking note of the person line objects in these studies (which you’ll be able to request totally free from every of the bureaus), you possibly can keep alert for any false info.

Incorrect info in your credit score report can come up for a number of causes. Id fraud is among the most urgent points. Although easy errors also can happen, they have to be handled swiftly to keep away from complications.

Conclusion

Credit score scores can appear complicated and even overwhelming. There are a number of bureaus and hundreds of potential lenders, every of which has particular standards for evaluating creditworthiness.

The excellent news is that many choices can be found for anybody seeking to borrow cash or get money quick. Although having a superb credit score rating is all the time useful, it is not strictly mandatory. And regardless of whether or not you require funds, you possibly can attempt to enhance your credit score scores. Some lenders provide loans to these with poor credit score.

One choice you might want to contemplate if you’re in search of loans you possibly can receive with any credit score is Money 1 Loans. We provide varied choices, from title loans to installment loans to strains of credit score. Our short-term loans will help you get money in your pocket rapidly, so you possibly can cowl your bills and get again to specializing in the issues that matter most.

A credit score bureau is a corporation that aggregates information on particular person customers and sells that information to lenders. These bureaus permit potential lenders perception into the creditworthiness of a possible debtor.

Credit score bureaus collect info from a big selection of sources. Totally different monetary establishments report information to credit score bureaus. These primarily embody banks and credit score unions however lengthen to auto lenders, bank card issuers, and on-line lenders. Moreover, credit score bureaus discover different obtainable public information starting from court docket orders to property information.

The main credit score bureaus in the US are Equifax, Experian, and TransUnion. Every of those organizations calculates credit score studies barely in a different way, that means it is common to get various outcomes from the completely different bureaus. Many potential lenders use a mean of the three scores to get essentially the most holistic understanding doable.

Whereas this may increasingly appear complicated, the excellent news is that each one three bureaus are in search of related patterns after they analyze your credit score historical past. For instance, they need to see on-time funds, a wholesome credit score combine, and low utilization in your strains of credit score.

This text will cowl the fundamentals of how credit score bureaus work, why they’re important, and what’s their main operate.

Why are Credit score Bureaus Essential?

Lenders should rigorously contemplate credit score danger when deciding whether or not or to not lend cash to a person shopper. Lenders which are too lax with their necessities danger handing out funds that aren’t repaid, which is problematic for the group. However, lenders which are rigid with funds miss alternatives and lose potential purchasers.

Placing the proper steadiness is, subsequently, a vital process. Particular, unbiased information aggregation and reporting turn out to be immensely precious. Credit score scores present goal metrics by which lenders could make selections.

What are these metrics, precisely? Lenders (and, by extension, credit score bureaus) are wanting to see that you’re not using a dangerously excessive share of your present credit score. They need to know that you’re paying all of your payments on time. They usually need to see that you’ve got maintained a wholesome combination of account varieties over a protracted interval.

It is value noting that shopper reporting companies don’t grant or deny loans. As a substitute, they calculate creditworthiness utilizing fee historical past and credit score info. Most lenders take into consideration a variety of things. Typically elements equivalent to earnings, financial savings, and present money owed can play an much more vital position than credit score scores in these lending selections. Nonetheless, credit score scores are a typical affect on lending selections.

How Does a Credit score Bureau Work?

Credit score bureaus obtain studies from varied establishments that permit them to construct a complete portrait of any particular person shopper’s monetary accounts. Utilizing quite a lot of elements present in your credit score historical past, these establishments calculate an general credit score rating, primarily starting from 300 to 850. The relative worth of every rating can fluctuate relying on the company reporting and the lender’s standards. Nonetheless, as a normal rule:

300 to 499 is taken into account Very Dangerous

500 to 600 is taken into account Poor

601 to 660 is taken into account Honest

661 to 780 is taken into account Good

781 to 850 is taken into account Wonderful

As we are going to focus on later on this article, your precise rating can rely on which bureau you ask. It could additionally rely on elements such because the circumstance wherein you’re making use of for credit score. FICO will calculate a barely completely different worth in your rating based mostly on private parts, equivalent to what kind of asset or mortgage you are trying to get.

What are the Three Most important Credit score Bureaus?

As famous within the introduction, the three essential credit score bureaus within the USA are Experian, Equifax, and TransUnion. These firms coordinate with lenders throughout the nation to assemble and manage an up-to-date database containing info on the credit score historical past of thousands and thousands of People. This info empowers firms to know the dangers related to any mortgage they might contemplate giving. It additionally permits customers to benefit from credit score by constructing a optimistic rating. (Although if you don’t at present have a superb credit score rating, low credit score choices can be found for you, too.)

Which Credit score Bureau is Most Typically Used?

Of the three essential credit score bureaus, Experian is the most important. Nonetheless, Equifax and TransUnion are incessantly used and vital credit score bureaus. It would be best to control all three main credit score reporting companies to trace your credit score rating and monitor the studies for errors. Collectively, these three bureaus are essentially the most used and best-recognized companies in the US. And almost any kind of mortgage you attempt to get will take your studies from these companies into consideration a method or one other.

What Does a Credit score Bureau Do?

Establishments equivalent to Experian, Equifax, and Transunion are information collectors. They coordinate with banks, credit score unions, and different lending establishments whereas researching publicly obtainable info to type monetary overviews of particular person customers.

Credit score Bureaus then promote that info to potential lenders who need to make educated decisions relating to how a lot cash they lend to any particular person. (And whom they need to not lend to within the first place.)

What Info is Collected by Credit score Bureaus?

Just a few items of knowledge recurrently analyzed by credit score bureaus embody:

- Cost historical past

- Account balances

- Account open dates

- Date of the final exercise

- Excessive credit score on an account

- The credit score restrict on every account

Companies equivalent to Equifax additionally accumulate info on debt collections and bankruptcies.

How Does the Credit score Bureau Get Info?

Credit score bureaus have prepared entry to info in your monetary accounts as a result of lenders readily share that information. Lenders voluntarily adjust to these requests as a result of the credit score bureaus have a longstanding repute and since lenders depend on the credit score studies that Bureaus obtain.

Information relating to on-time funds, account balances, and so forth., then get aggregated right into a remaining rating based mostly on all this info. FICO and VantageScore are the most typical scoring methods, which have slowly converged into more and more related algorithms. Each methods now weigh customers on a scale of 300 (Low) to 850 (Excessive) by way of credit score scores.

Why Do I Get Totally different Credit score Scores for Every Bureau?

Some customers want clarification after they first examine their scores and see that completely different bureaus have completely different scores. Chill out: it is a widespread incidence. This will occur for a number of causes.

- Totally different bureaus could maintain completely different schedules for accumulating and aggregating info, that means they base your scores on barely completely different home windows of time.

- Some lenders could report to at least one or two credit score bureaus, whereas others report back to all three.

- Bureaus can use completely different scoring fashions which calculate your rating a little bit in a different way.

Along with variations between bureaus, completely different lenders may additionally use barely completely different standards. FICO, for instance, affords many distinct fashions for evaluating creditworthiness. They could present a rating for auto lending and place extra significance on somebody’s auto fee historical past over their on-time bank card invoice funds, for instance.

Discrepancies between bureaus are sometimes no trigger for concern. Nonetheless, this subject does underscore the significance of conserving tabs in your credit score studies. By taking note of the person line objects in these studies (which you’ll be able to request totally free from every of the bureaus), you possibly can keep alert for any false info.

Incorrect info in your credit score report can come up for a number of causes. Id fraud is among the most urgent points. Although easy errors also can happen, they have to be handled swiftly to keep away from complications.

Conclusion

Credit score scores can appear complicated and even overwhelming. There are a number of bureaus and hundreds of potential lenders, every of which has particular standards for evaluating creditworthiness.

The excellent news is that many choices can be found for anybody seeking to borrow cash or get money quick. Although having a superb credit score rating is all the time useful, it is not strictly mandatory. And regardless of whether or not you require funds, you possibly can attempt to enhance your credit score scores. Some lenders provide loans to these with poor credit score.

One choice you might want to contemplate if you’re in search of loans you possibly can receive with any credit score is Money 1 Loans. We provide varied choices, from title loans to installment loans to strains of credit score. Our short-term loans will help you get money in your pocket rapidly, so you possibly can cowl your bills and get again to specializing in the issues that matter most.