If you already know what a credit score rating is, you will know that almost all banks and monetary establishments usually use it to measure an individual’s chance of repaying the debt once they apply for credit score. Your credit score rating gives an instantaneous image of your creditworthiness to lenders. Though some individuals with poor credit score scores can nonetheless qualify for loans, the applying process will not be as easy. If you end up in an identical state of affairs, there are methods chances are you’ll apply to lift your credit score rating.

Constructing a stable credit score historical past does not essentially need to take plenty of effort and time. A very good rating will be a vital issue that makes borrowing cash easy. However earlier than leaping into something, let’s first perceive what an excellent credit score rating means.

What’s a Good Credit score Rating?

No rating ensures higher mortgage phrases or charges as a result of everybody’s credit score state of affairs differs. With that stated, it is broadly accepted {that a} credit score rating ranges from 300-850. Scores of 740 and better are considered excellent. A credit score rating of round 670 to 739 is mostly thought of good. Whereas these between 580 to 669 are considered within the truthful class. A rating below 580 is taken into account to be a a bad credit score rating . In case your aim is to lift your credit score rating, understanding what influences your credit score scores and the way your monetary conduct might assist or hinder them is essential.

What Components Have an effect on Your Credit score Scores?

Though completely different credit-scoring fashions might give various ranges of significance to every piece of data in your credit score report, the widespread elements that have an effect on any credit score rating are within the following 5 classes:

Fee historical past:

One of many important credit score scoring elements is your fee historical past. Your credit score rankings can enhance by making well timed funds in your accounts. Nevertheless, failing to make funds, having an unpaid debt despatched to a group company, or declaring chapter might decrease your credit score rating.

Credit score utilization:

The quantity of credit score you might have in contrast with how a lot credit score a lender has prolonged you’re straightforward to find out within the case of installment loans like private loans. However, your credit score utilization ratio provides a share worth of the entire excellent balances and your complete credit score restrict on all of your revolving accounts, like bank cards and contours of credit score. A decrease utilization charge is taken into account higher on your credit score scores.

Credit score Size:

You want some credit score historical past to get a credit score rating, making this an essential issue affecting your credit score rating. It consists of the age of your oldest and latest accounts, the common age of all of your credit score accounts, and whether or not you have used a credit score account just lately. It is clever to think about the influence of the size of credit score historical past in your credit score scores earlier than opening or closing a credit score account.

Credit score Combine:

Your scores may enhance in case you reveal you could responsibly handle several types of credit score, like revolving credit score and installment credit score. You should not get a mortgage and pay curiosity solely so as to add it to your credit score combine as a result of it has little affect in your credit score rating. Nevertheless, if all of your borrowing has been by means of installment loans solely, you may want to apply for a bank card and use it to make small manageable funds every month.

Latest Credit score:

Whenever you apply for a brand new line of credit score, collectors can examine your credit score reviews. This can lead to a credit score inquiry, which might seem in your credit score reviews for as much as two years. Your credit score scores are unaffected by comfortable queries, equivalent to people who consequence from checking your scores and a few prequalification for loans or bank cards. Nevertheless, arduous inquiries, which happen when a creditor examines your credit score earlier than making a lending choice, can shift your rating from an excellent credit score rating vary to a poor or truthful one.

What to Anticipate with Your Credit score Rating Vary

There are quite a few credit-scoring fashions, every producing credit score scores based mostly on the information in your credit score report utilizing a novel system. FICO® (Honest Isaac Company) and VantageScore® are the 2 most well-known credit-scoring firms in the USA. With a number of variations, FICO® and VantageScore® at present vary from 300 to 850.

There are basic rating ranges inside this scale that almost all collectors use to make lending choices. You should use these ranges to know your present state of affairs and set monetary targets. Listed here are a few of the credit score rating ranges:

Poor to truthful scores:

You may need hassle being accredited for quite a few bank cards or loans in case your rating is poor to truthful. To ascertain or restore your credit score, you may want to start out with a secured bank card or credit-builder mortgage.

Honest to good scores:

You probably have a good to good credit score rating, you may need extra credit score choices, however you won’t obtain one of the best charges or phrases. Though you do not have the best or the bottom threat to lenders, there may be nonetheless potential so that you can elevate your credit score rating and enhance your monetary state of affairs.

Excellent or glorious scores:

You probably have an excellent or glorious rating, you usually tend to get a mortgage with low-interest charges and cheap compensation phrases. Whereas collectors take into account different points when figuring out your eligibility, your credit score rating will most likely not be a barrier.

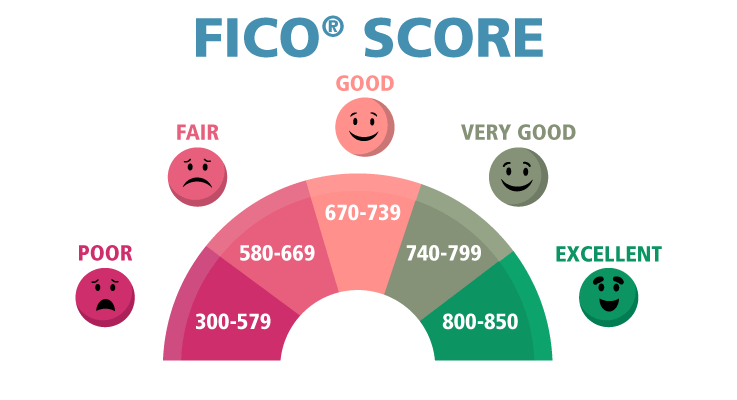

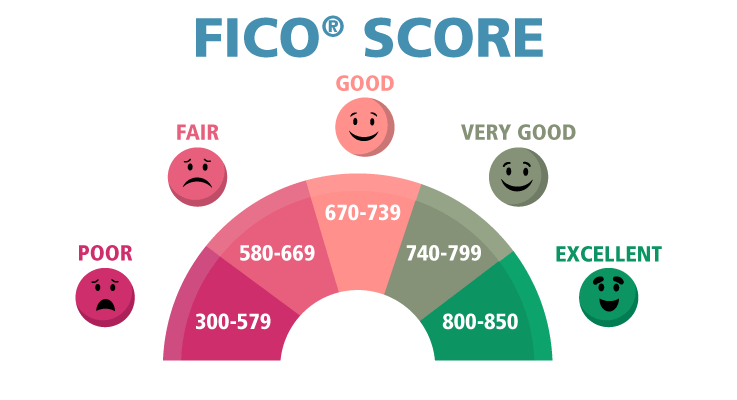

What’s a Good FICO® Rating?

FICO® Scores are developed by the Honest Isaac Company, which claims that over 90% of the highest lenders make the most of solely FICO® Scores when making lending choices. This credit score scoring mannequin makes use of buyer data from TransUnion, Equifax, and Experian, the three main credit score reporting businesses.

As proven within the above picture, an excellent FICO® rating is between 670 and 739. Scores between 580 and 669 are thought of truthful, whereas these between 740 and 799 are deemed “excellent.” A rating of 800 or greater is claimed to be “glorious.” And lastly, a “poor” rating falls between 300 and 579.

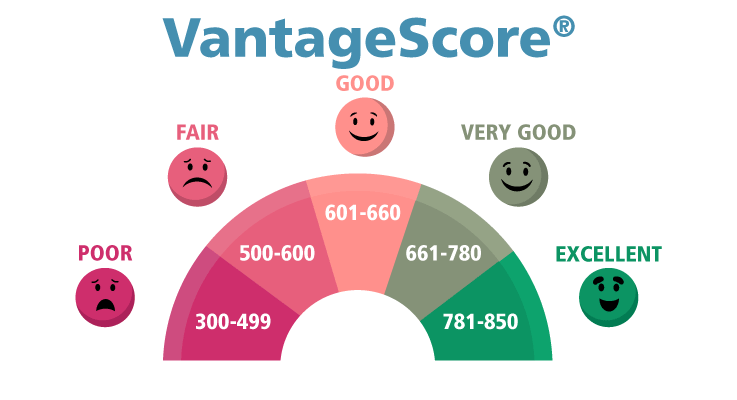

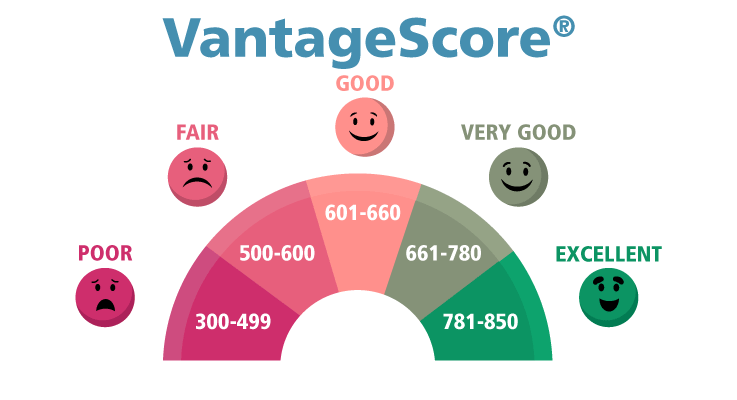

What’s a Good VantageScore®?

Equifax, TransUnion, and Experian, the identical three credit standing firms FICO® makes use of to create its rankings, based VantageScore® in 2006. They aimed to compete with the extra well-known FICO® scores. FICO® and VantageScore® take into account making funds on time essential for patrons to enhance their credit score scores.

The ranges of the primary two VantageScore® credit score scoring fashions had been 501 and 990. The 300 to 850 scoring vary is utilized by the 2 most up-to-date VantageScore® credit score scores (VantageScore® 3.0 and 4.0). The present VantageScore® mannequin classifies 661 to 780 as its good credit score rating vary.

Why is It Vital to Have a Good Credit score Rating?

Attaining your monetary and private targets can grow to be extra easy with an excellent credit score rating. It might considerably influence the quantity you may borrow and the curiosity or charges you will need to pay on approval. Credit score rankings may affect non-lending choices, together with a landlord’s choice to allow you to hire an house. Some employers might examine your credit score data earlier than hiring or selling. Moreover, insurance coverage companies might make the most of credit-based insurance coverage scores in most states to determine your life, residence, and automobile insurance coverage premiums.

How you can Get Good Credit score?

Establishing and sustaining an excellent credit score historical past shouldn’t be overly difficult. Here is an inventory of straightforward monetary habits and behaviors you may observe to construct an excellent rating:

- Since your fee historical past is taken into account to have probably the most important impact in your rating, you must at all times pay payments on time.

- In accordance with specialists, maintaining your credit score restrict beneath 30% and even much less is healthier.

- It’s best to keep away from making use of for a number of credit score functions in brief intervals, decreasing your rating.

- Verify your credit score scores and reviews month-to-month to keep away from incorrect or previous data.

- Having an extended historical past of managing bank cards and loans, particularly one stuffed with funds made on time, will enable you construct glorious credit score.

How Lengthy Does It Take to Construct Good Credit score?

First, you must do not forget that constructing good credit score will not occur in a single day. Secondly, it significantly will depend on the place you are at within the scoring vary and what monetary difficulties you are dealing with. In the event you’re a younger grownup and have simply entered the world of credit score, you may start to construct credit score by including accounts to your credit score reviews. You will not have a credit score rating if in case you have newly created credit score accounts in your credit score reviews till you have had them for some time. After no less than one account has been open and on file for six months, you may have the ability to see a FICO® Rating develop. Nevertheless, a VantageScore® will create significantly extra shortly. You may get a VantageScore® in case your credit score rating contains no less than one account.

It might take years for damaging data in your credit score reviews, equivalent to missed or late funds or chapter, to vanish and cease impacting your scores. Though will probably be years earlier than these damaging markings disappear, you may nonetheless discover a big enchancment. Keep in mind, the principle thought is to constantly deal with enhancing your credit score and notice that the method takes time.

What’s the Advantage of Having a Good Credit score Rating?

Enhance your probabilities of mortgage and bank card approval

Get decrease rates of interest and phrases from the lenders

Makes leasing an house or shopping for a house simpler

Lower your expenses in your auto and house owner’s insurance coverage

Get accredited for greater credit score limits

What’s a Good Credit score Rating for Lenders?

Larger scores create extra lender confidence that you’ll repay your debt as agreed. However lenders can set their definitions for what they take into account good or a bad credit score scores when evaluating you for bank cards and loans. Some lenders construct their customized credit-scoring fashions, however the two commonest ones are these developed by FICO® and VantageScore®.

Conclusion

A very good credit score rating is the one that may enable you get what you want, whether or not it is faster entry to new loans, getting a brand new job, or lowering mortgage charges. On the identical time, good credit score can also be subjective to the lender you select.

It’s best to make some extent to examine your credit score rating earlier than making use of for a brand new mortgage or bank card. Doing this can enable you perceive your prospects of acquiring favorable phrases. As well as, checking your credit score rating earlier gives you the prospect to lift it and maybe keep away from paying a whole bunch and even hundreds of {dollars} in curiosity.

Monitoring your rating can assist you’re taking steps to lift it, growing your probabilities of being accredited for a mortgage, bank card, house lease, or insurance coverage coverage whereas additionally strengthening your monetary state of affairs.

If you already know what a credit score rating is, you will know that almost all banks and monetary establishments usually use it to measure an individual’s chance of repaying the debt once they apply for credit score. Your credit score rating gives an instantaneous image of your creditworthiness to lenders. Though some individuals with poor credit score scores can nonetheless qualify for loans, the applying process will not be as easy. If you end up in an identical state of affairs, there are methods chances are you’ll apply to lift your credit score rating.

Constructing a stable credit score historical past does not essentially need to take plenty of effort and time. A very good rating will be a vital issue that makes borrowing cash easy. However earlier than leaping into something, let’s first perceive what an excellent credit score rating means.

What’s a Good Credit score Rating?

No rating ensures higher mortgage phrases or charges as a result of everybody’s credit score state of affairs differs. With that stated, it is broadly accepted {that a} credit score rating ranges from 300-850. Scores of 740 and better are considered excellent. A credit score rating of round 670 to 739 is mostly thought of good. Whereas these between 580 to 669 are considered within the truthful class. A rating below 580 is taken into account to be a a bad credit score rating . In case your aim is to lift your credit score rating, understanding what influences your credit score scores and the way your monetary conduct might assist or hinder them is essential.

What Components Have an effect on Your Credit score Scores?

Though completely different credit-scoring fashions might give various ranges of significance to every piece of data in your credit score report, the widespread elements that have an effect on any credit score rating are within the following 5 classes:

Fee historical past:

One of many important credit score scoring elements is your fee historical past. Your credit score rankings can enhance by making well timed funds in your accounts. Nevertheless, failing to make funds, having an unpaid debt despatched to a group company, or declaring chapter might decrease your credit score rating.

Credit score utilization:

The quantity of credit score you might have in contrast with how a lot credit score a lender has prolonged you’re straightforward to find out within the case of installment loans like private loans. However, your credit score utilization ratio provides a share worth of the entire excellent balances and your complete credit score restrict on all of your revolving accounts, like bank cards and contours of credit score. A decrease utilization charge is taken into account higher on your credit score scores.

Credit score Size:

You want some credit score historical past to get a credit score rating, making this an essential issue affecting your credit score rating. It consists of the age of your oldest and latest accounts, the common age of all of your credit score accounts, and whether or not you have used a credit score account just lately. It is clever to think about the influence of the size of credit score historical past in your credit score scores earlier than opening or closing a credit score account.

Credit score Combine:

Your scores may enhance in case you reveal you could responsibly handle several types of credit score, like revolving credit score and installment credit score. You should not get a mortgage and pay curiosity solely so as to add it to your credit score combine as a result of it has little affect in your credit score rating. Nevertheless, if all of your borrowing has been by means of installment loans solely, you may want to apply for a bank card and use it to make small manageable funds every month.

Latest Credit score:

Whenever you apply for a brand new line of credit score, collectors can examine your credit score reviews. This can lead to a credit score inquiry, which might seem in your credit score reviews for as much as two years. Your credit score scores are unaffected by comfortable queries, equivalent to people who consequence from checking your scores and a few prequalification for loans or bank cards. Nevertheless, arduous inquiries, which happen when a creditor examines your credit score earlier than making a lending choice, can shift your rating from an excellent credit score rating vary to a poor or truthful one.

What to Anticipate with Your Credit score Rating Vary

There are quite a few credit-scoring fashions, every producing credit score scores based mostly on the information in your credit score report utilizing a novel system. FICO® (Honest Isaac Company) and VantageScore® are the 2 most well-known credit-scoring firms in the USA. With a number of variations, FICO® and VantageScore® at present vary from 300 to 850.

There are basic rating ranges inside this scale that almost all collectors use to make lending choices. You should use these ranges to know your present state of affairs and set monetary targets. Listed here are a few of the credit score rating ranges:

Poor to truthful scores:

You may need hassle being accredited for quite a few bank cards or loans in case your rating is poor to truthful. To ascertain or restore your credit score, you may want to start out with a secured bank card or credit-builder mortgage.

Honest to good scores:

You probably have a good to good credit score rating, you may need extra credit score choices, however you won’t obtain one of the best charges or phrases. Though you do not have the best or the bottom threat to lenders, there may be nonetheless potential so that you can elevate your credit score rating and enhance your monetary state of affairs.

Excellent or glorious scores:

You probably have an excellent or glorious rating, you usually tend to get a mortgage with low-interest charges and cheap compensation phrases. Whereas collectors take into account different points when figuring out your eligibility, your credit score rating will most likely not be a barrier.

What’s a Good FICO® Rating?

FICO® Scores are developed by the Honest Isaac Company, which claims that over 90% of the highest lenders make the most of solely FICO® Scores when making lending choices. This credit score scoring mannequin makes use of buyer data from TransUnion, Equifax, and Experian, the three main credit score reporting businesses.

As proven within the above picture, an excellent FICO® rating is between 670 and 739. Scores between 580 and 669 are thought of truthful, whereas these between 740 and 799 are deemed “excellent.” A rating of 800 or greater is claimed to be “glorious.” And lastly, a “poor” rating falls between 300 and 579.

What’s a Good VantageScore®?

Equifax, TransUnion, and Experian, the identical three credit standing firms FICO® makes use of to create its rankings, based VantageScore® in 2006. They aimed to compete with the extra well-known FICO® scores. FICO® and VantageScore® take into account making funds on time essential for patrons to enhance their credit score scores.

The ranges of the primary two VantageScore® credit score scoring fashions had been 501 and 990. The 300 to 850 scoring vary is utilized by the 2 most up-to-date VantageScore® credit score scores (VantageScore® 3.0 and 4.0). The present VantageScore® mannequin classifies 661 to 780 as its good credit score rating vary.

Why is It Vital to Have a Good Credit score Rating?

Attaining your monetary and private targets can grow to be extra easy with an excellent credit score rating. It might considerably influence the quantity you may borrow and the curiosity or charges you will need to pay on approval. Credit score rankings may affect non-lending choices, together with a landlord’s choice to allow you to hire an house. Some employers might examine your credit score data earlier than hiring or selling. Moreover, insurance coverage companies might make the most of credit-based insurance coverage scores in most states to determine your life, residence, and automobile insurance coverage premiums.

How you can Get Good Credit score?

Establishing and sustaining an excellent credit score historical past shouldn’t be overly difficult. Here is an inventory of straightforward monetary habits and behaviors you may observe to construct an excellent rating:

- Since your fee historical past is taken into account to have probably the most important impact in your rating, you must at all times pay payments on time.

- In accordance with specialists, maintaining your credit score restrict beneath 30% and even much less is healthier.

- It’s best to keep away from making use of for a number of credit score functions in brief intervals, decreasing your rating.

- Verify your credit score scores and reviews month-to-month to keep away from incorrect or previous data.

- Having an extended historical past of managing bank cards and loans, particularly one stuffed with funds made on time, will enable you construct glorious credit score.

How Lengthy Does It Take to Construct Good Credit score?

First, you must do not forget that constructing good credit score will not occur in a single day. Secondly, it significantly will depend on the place you are at within the scoring vary and what monetary difficulties you are dealing with. In the event you’re a younger grownup and have simply entered the world of credit score, you may start to construct credit score by including accounts to your credit score reviews. You will not have a credit score rating if in case you have newly created credit score accounts in your credit score reviews till you have had them for some time. After no less than one account has been open and on file for six months, you may have the ability to see a FICO® Rating develop. Nevertheless, a VantageScore® will create significantly extra shortly. You may get a VantageScore® in case your credit score rating contains no less than one account.

It might take years for damaging data in your credit score reviews, equivalent to missed or late funds or chapter, to vanish and cease impacting your scores. Though will probably be years earlier than these damaging markings disappear, you may nonetheless discover a big enchancment. Keep in mind, the principle thought is to constantly deal with enhancing your credit score and notice that the method takes time.

What’s the Advantage of Having a Good Credit score Rating?

Enhance your probabilities of mortgage and bank card approval

Get decrease rates of interest and phrases from the lenders

Makes leasing an house or shopping for a house simpler

Lower your expenses in your auto and house owner’s insurance coverage

Get accredited for greater credit score limits

What’s a Good Credit score Rating for Lenders?

Larger scores create extra lender confidence that you’ll repay your debt as agreed. However lenders can set their definitions for what they take into account good or a bad credit score scores when evaluating you for bank cards and loans. Some lenders construct their customized credit-scoring fashions, however the two commonest ones are these developed by FICO® and VantageScore®.

Conclusion

A very good credit score rating is the one that may enable you get what you want, whether or not it is faster entry to new loans, getting a brand new job, or lowering mortgage charges. On the identical time, good credit score can also be subjective to the lender you select.

It’s best to make some extent to examine your credit score rating earlier than making use of for a brand new mortgage or bank card. Doing this can enable you perceive your prospects of acquiring favorable phrases. As well as, checking your credit score rating earlier gives you the prospect to lift it and maybe keep away from paying a whole bunch and even hundreds of {dollars} in curiosity.

Monitoring your rating can assist you’re taking steps to lift it, growing your probabilities of being accredited for a mortgage, bank card, house lease, or insurance coverage coverage whereas additionally strengthening your monetary state of affairs.