Hitting the highway and going to lovely locations in an RV sounds interesting. With its built-in beds, fully-equipped kitchen, and different dwelling facilities, you’ve gotten the liberty to go and keep as you please. Consolation and comfort clever, you’ll be able to by no means go mistaken with an RV journey.

Nevertheless, it is most likely one of the crucial vital purchases you may ever make. With a price ticket starting from $10,000 to over $1 million, many individuals have to show to financing to purchase and personal an RV. There are numerous RV loans on the market, however it’s not all the time simple to get accepted for one. Sure elements will have an effect on your possibilities to get RV financing, and your credit score rating is amongst them.

Listed below are important issues you might want to find out about credit score scores for RV financing. It could be greatest to equip your self with them, particularly if you happen to’re planning to get your RV.

How Does RV Financing Work?

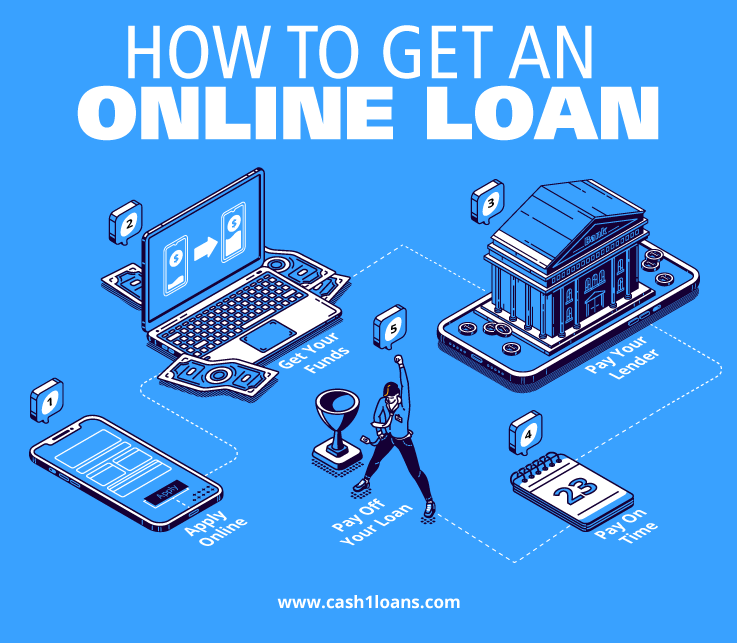

Financing an RV is just about much like financing a automotive or a home. You may get it from lenders or collectors who’re providing RV loans, resembling banks, credit score unions, or RV sellers. Identical to a automotive mortgage, you can be required to place in a downpayment after which make month-to-month repayments inside a sure interval.

Most RV loans are secured, which means the RV itself serves as collateral to ensure the mortgage. If you cannot make your month-to-month funds, the lender has the best to repossess the RV. Though some lenders provide unsecured RV loans, the rates of interest can be considerably increased.

RV loans’ value could range relying on the rate of interest the lender prices you and the mortgage time period or period of time you must repay the mortgage. Thus, it will be greatest to check completely different lenders’ choices to get essentially the most reasonably priced RV mortgage doable for you. However be aware that these lenders take a look at a number of elements when deciding to provide you credit score or not.

Understanding The Function of Credit score Rating

A credit score rating is among the many elements that lenders use to judge how appropriate you might be to obtain the mortgage. Since a credit score rating is predicated on credit score historical past, which incorporates the variety of your open accounts, whole ranges of your money owed, and your reimbursement historical past, the lender can have an thought of how possible you might be to repay the mortgage on time.

Though it is just one part, credit score scores could make or break RV financing. Learn the way an excellent or poor credit rating impacts your possibilities for higher charges and phrases and your RV mortgage approval.

Good Credit score Rating

As with every mortgage product, having good credit score often works in your favor. A credit score rating round 700 or increased will make it simpler and quicker so that you can get an RV mortgage. When you’ve got such a excessive rating, lenders are more likely to understand you as low credit score threat. Thus, you’re going to get higher and decrease charges in your mortgage.

Dangerous Credit score Rating

Alternatively, having poor credit would not essentially imply you will not get accepted for RV financing. However although it isn’t completely unattainable to get an RV mortgage when you’ve gotten a low credit score rating, it might probably definitely restrict your choices. Many lenders could provide RV loans to debtors with scores of 550 however with increased rates of interest and revenue necessities.

How To Enhance Your Credit score Rating

If you wish to higher your possibilities for good credit score RV financing, however you are at the moment scuffling with credit score challenges, do not lose hope. There are a number of methods to enhance your credit score although it requires an awesome effort in your half.

As an alternative of bearing sky-high rates of interest and charges in your RV mortgage as a result of poor credit, take into account the next to spice up your credit score rating earlier than you apply for RV financing.

Assessment Your Credit score Report

Step one in enhancing your credit score is discovering out which elements have an effect on your scores essentially the most. To do that, you would need to get a replica of your credit score report and evaluation each merchandise. As soon as you recognize what issue helps or hurts your rating, you’ll be able to higher make modifications to enhance them.

There are additionally situations the place there are errors in your credit score report, resembling mistaken account standing, duplicated money owed, and incorrect balances. These errors might drag down your rating. By checking your credit score report, you’ll be able to right and take away them by submitting a dispute.

Pay Payments On Time

Your cost historical past determines 35% of your credit score rating and has the most important influence. Thus, the best strategy to increase your credit score is to make funds on time. In case you’re behind on any cost, pay them as quickly as doable. It should additionally assist if you happen to use automated cost or calendar reminders to make sure you pay on time every month.

Do not forget that lenders have an interest to understand how dependable you might be in paying your payments. They take into account your cost historical past as an excellent predictor of future efficiency. In case you fail on this facet, work on this as quickly as you’ll be able to.

Scale back The Quantity of Debt

The quantity of debt you’ve gotten also can have an effect on your credit score rating. In case you’re carrying a number of money owed, it is higher to pay them off earlier than making use of for RV financing. Paying off your excellent balances will help increase your credit score rating because you’re reducing your credit score utilization. Notice {that a} low credit score utilization ratio tells lenders how properly you handle your credit score.

Important Factors To Bear in mind

There isn’t a shortcut to enhance your credit score rating. It might take some effort and time earlier than you’ll be able to see the modifications. Furthermore, the adverse info in your credit score report could stay for a sure interval. If you’ve completed every part you possibly can, all you might want to do is wait till the adverse gadgets fall off.

Takeaway

Your credit score rating could not solely have an effect on your probabilities of getting RV financing. However it might probably additionally have an effect on your monetary well being and life generally. When you’ve gotten poor credit score, chances are you’ll not get the house and job you need since landlords and employers could run a credit score verify. Subsequently, you will need to all the time care for your credit score rating whether or not you are making use of for RV financing or not.

Writer Bio:

Lauren Cordell is a monetary knowledgeable who writes in numerous entrepreneur magazines. Her writings are all the time filled with information and real-life experiences. In her free time, you may possible discover her studying books about enterprise and private finance.

Hitting the highway and going to lovely locations in an RV sounds interesting. With its built-in beds, fully-equipped kitchen, and different dwelling facilities, you’ve gotten the liberty to go and keep as you please. Consolation and comfort clever, you’ll be able to by no means go mistaken with an RV journey.

Nevertheless, it is most likely one of the crucial vital purchases you may ever make. With a price ticket starting from $10,000 to over $1 million, many individuals have to show to financing to purchase and personal an RV. There are numerous RV loans on the market, however it’s not all the time simple to get accepted for one. Sure elements will have an effect on your possibilities to get RV financing, and your credit score rating is amongst them.

Listed below are important issues you might want to find out about credit score scores for RV financing. It could be greatest to equip your self with them, particularly if you happen to’re planning to get your RV.

How Does RV Financing Work?

Financing an RV is just about much like financing a automotive or a home. You may get it from lenders or collectors who’re providing RV loans, resembling banks, credit score unions, or RV sellers. Identical to a automotive mortgage, you can be required to place in a downpayment after which make month-to-month repayments inside a sure interval.

Most RV loans are secured, which means the RV itself serves as collateral to ensure the mortgage. If you cannot make your month-to-month funds, the lender has the best to repossess the RV. Though some lenders provide unsecured RV loans, the rates of interest can be considerably increased.

RV loans’ value could range relying on the rate of interest the lender prices you and the mortgage time period or period of time you must repay the mortgage. Thus, it will be greatest to check completely different lenders’ choices to get essentially the most reasonably priced RV mortgage doable for you. However be aware that these lenders take a look at a number of elements when deciding to provide you credit score or not.

Understanding The Function of Credit score Rating

A credit score rating is among the many elements that lenders use to judge how appropriate you might be to obtain the mortgage. Since a credit score rating is predicated on credit score historical past, which incorporates the variety of your open accounts, whole ranges of your money owed, and your reimbursement historical past, the lender can have an thought of how possible you might be to repay the mortgage on time.

Though it is just one part, credit score scores could make or break RV financing. Learn the way an excellent or poor credit rating impacts your possibilities for higher charges and phrases and your RV mortgage approval.

Good Credit score Rating

As with every mortgage product, having good credit score often works in your favor. A credit score rating round 700 or increased will make it simpler and quicker so that you can get an RV mortgage. When you’ve got such a excessive rating, lenders are more likely to understand you as low credit score threat. Thus, you’re going to get higher and decrease charges in your mortgage.

Dangerous Credit score Rating

Alternatively, having poor credit would not essentially imply you will not get accepted for RV financing. However although it isn’t completely unattainable to get an RV mortgage when you’ve gotten a low credit score rating, it might probably definitely restrict your choices. Many lenders could provide RV loans to debtors with scores of 550 however with increased rates of interest and revenue necessities.

How To Enhance Your Credit score Rating

If you wish to higher your possibilities for good credit score RV financing, however you are at the moment scuffling with credit score challenges, do not lose hope. There are a number of methods to enhance your credit score although it requires an awesome effort in your half.

As an alternative of bearing sky-high rates of interest and charges in your RV mortgage as a result of poor credit, take into account the next to spice up your credit score rating earlier than you apply for RV financing.

Assessment Your Credit score Report

Step one in enhancing your credit score is discovering out which elements have an effect on your scores essentially the most. To do that, you would need to get a replica of your credit score report and evaluation each merchandise. As soon as you recognize what issue helps or hurts your rating, you’ll be able to higher make modifications to enhance them.

There are additionally situations the place there are errors in your credit score report, resembling mistaken account standing, duplicated money owed, and incorrect balances. These errors might drag down your rating. By checking your credit score report, you’ll be able to right and take away them by submitting a dispute.

Pay Payments On Time

Your cost historical past determines 35% of your credit score rating and has the most important influence. Thus, the best strategy to increase your credit score is to make funds on time. In case you’re behind on any cost, pay them as quickly as doable. It should additionally assist if you happen to use automated cost or calendar reminders to make sure you pay on time every month.

Do not forget that lenders have an interest to understand how dependable you might be in paying your payments. They take into account your cost historical past as an excellent predictor of future efficiency. In case you fail on this facet, work on this as quickly as you’ll be able to.

Scale back The Quantity of Debt

The quantity of debt you’ve gotten also can have an effect on your credit score rating. In case you’re carrying a number of money owed, it is higher to pay them off earlier than making use of for RV financing. Paying off your excellent balances will help increase your credit score rating because you’re reducing your credit score utilization. Notice {that a} low credit score utilization ratio tells lenders how properly you handle your credit score.

Important Factors To Bear in mind

There isn’t a shortcut to enhance your credit score rating. It might take some effort and time earlier than you’ll be able to see the modifications. Furthermore, the adverse info in your credit score report could stay for a sure interval. If you’ve completed every part you possibly can, all you might want to do is wait till the adverse gadgets fall off.

Takeaway

Your credit score rating could not solely have an effect on your probabilities of getting RV financing. However it might probably additionally have an effect on your monetary well being and life generally. When you’ve gotten poor credit score, chances are you’ll not get the house and job you need since landlords and employers could run a credit score verify. Subsequently, you will need to all the time care for your credit score rating whether or not you are making use of for RV financing or not.

Writer Bio:

Lauren Cordell is a monetary knowledgeable who writes in numerous entrepreneur magazines. Her writings are all the time filled with information and real-life experiences. In her free time, you may possible discover her studying books about enterprise and private finance.