Having a good credit score rating is best than having low credit score however actually not as nice as having a very good credit score rating. In case your credit score rating falls underneath the honest rating bracket, you may need fewer monetary alternatives obtainable. Work on constructing your credit score rating till you may have good or wonderful credit score. You will achieve entry to decrease rates of interest, higher bank cards, and extra.

To keep away from making unhealthy monetary selections and know your obtainable credit score choices, it is best to perceive the place your credit score rating vary falls. On this article, let’s be taught what a good credit score rating is, the way it could influence your monetary state of affairs, and what steps you possibly can take to enhance it.

What’s a Truthful Credit score Rating?

A good credit score rating is a three-digit quantity that falls into the honest rating vary of the credit-scoring mannequin used to calculate it. Quite a few corporations use completely different credit score scoring fashions to calculate your credit score scores. What honest credit score means largely is determined by the credit score scores you contemplate and the corporate that calculated them.

FICO and VantageScore are the 2 standard credit score scoring fashions that use completely different formulation to find out a credit score rating. The credit score scores underneath each fashions fall on a scale of 300 to 850. You might solely see just a few distinctions between the scores obtained from VantageScore and FICO. Usually, an individual with a good FICO rating may also have a good rating from VantageScore.

FICO VantageScore 4.0 Poor: 300 to 579 Dangerous: 300 to 600 Truthful: 580 to 669 Truthful: 601 to 660 Good: 670 to 739 Good: 661 to 780 Excellent: 740 to 799 Not Obtainable Distinctive: 800 to 850 Glorious: 781 to 850

What’s a Truthful FICO Rating?

In keeping with FICO, a good credit score rating is a credit score rating starting from 580 to 669. FICO scores are essentially the most extensively used credit score scores, with 90% of high lenders utilizing them when making lending selections.

When you’ve got a FICO rating between 580 to 669, your rating is taken into account under the common U.S. shopper rating. Many lenders will nonetheless approve loans with this rating, however there are probabilities that your rates of interest are on the upper aspect. Nonetheless, a rating within the mid-660s might get you a mortgage with comparatively higher charges than a good credit score rating within the 500s would.

What’s a Truthful VantageScore?

A good rating, as per VantageScore, ranges from 601 to 660. The three main credit score bureaus, Equifax, Experian, and TransUnion, created the VantageScore credit score scoring mannequin in March 2006 to compete with the FICO rating produced by Truthful Isaac Corp. (FICO).

Is Truthful Credit score Good?

The common credit score rating in the US is 716, which falls within the FICO mannequin’s good credit score vary. Since your FICO rating, when you’ve got honest credit score, will likely be between 580 and 669, it is decrease than the nationwide common rating. Your credit score rating is neither good nor unhealthy when you’ve got honest credit score. As a result of it falls someplace within the center, a good credit score rating is often known as common. Usually, these with credit score scores of 660 or larger are thought-about to be low-risk debtors by lenders. Then again, these with credit score scores under 660 may need a decrease likelihood of getting loans with higher phrases.

Contemplate your honest credit score rating as a necessary path resulting in good credit score. As you show wholesome monetary habits, you would possibly see a lift in your credit score rating. Moreover, you will know what it takes to boost your rating when you perceive the credit score rating ranges and the methodology used to generate them.

How Does a Truthful Credit score Rating Work?

Your credit score rating is a big three-digit quantity decided by the credit score historical past recorded in your credit score experiences. Lenders use it to evaluate your creditworthiness, how seemingly you will pay again your loans on time, and to determine whether or not or to not lend you cash. Debtors typically desire a good or wonderful rating. It is believed that the upper your rating, the higher your probabilities of getting authorized for a mortgage and securing a low annual proportion price (APR).

In case your credit score rating is honest, lenders would in all probability contemplate you a subprime borrower – somebody who will discover it difficult to repay their money owed. You might typically face refusals for a mortgage, bank card, or one other sort of credit score. Even if you’re accepted, some lenders would possibly cost a better APR for a borrower with honest credit score than somebody with robust credit score. Over the mortgage time period, your honest credit standing might value you lots of and even hundreds of {dollars}. So, given an opportunity, it is best to at all times attempt to enhance your credit score scores.

Enhance Your Truthful Credit score Rating

Though you is likely to be eligible for loans with honest credit score, elevating your rating might show you how to receive extra favorable mortgage phrases. You should utilize the next 4 steps to extend your honest credit score rating:

1. Handle Credit score Responsibly

There are numerous methods to indicate lenders that you’re a accountable borrower. Goal to make your funds on time every month to reveal to lenders that you simply adjust to the phrases of your mortgage settlement. Making late funds or skipping funds can decrease your credit score rating as a result of your fee historical past accounts for 35% of your credit score rating.

Your credit score utilization ratio is the ratio of credit score you may have used along with your complete obtainable credit score. It’s best to goal 30% or much less of your obtainable per account to take care of a wholesome credit score profile. As an example, in case your credit score restrict is $2,000, your month-to-month steadiness should not exceed $600. You may Attempt to maintain your utilization ratio even decrease if you wish to velocity up enhancing your credit score scores. This technique may also helps with maintain your debt in verify.

2. Constantly Monitor Your Credit score Report

Often reviewing your credit score experiences can help in guaranteeing the accuracy of the information reported to the credit score bureaus used to find out your credit score rating. AnnualCreditReport.com affords free copies of your credit score experiences from the three essential credit score bureaus: TransUnion, Equifax®, and Experian.

3. Keep away from exhausting inquiries from bank card functions

A excessive variety of credit score accounts opened shortly might decrease your score. Credit score scoring programs consider current inquiries. Once you apply for a bank card, the lender conducts a tough inquiry and punctiliously opinions your credit score report. With every exhausting inquiry, your credit score rating might be diminished by two to 5 factors. Making use of for bank cards you do not want or too many playing cards inside a brief interval can take your scores from honest to poor credit score vary. To keep away from having too many exhausting inquiries in your credit score document, solely apply for a bank card as soon as each 4 to 6 months.

4. Use Credit score Builder borrowing choices:

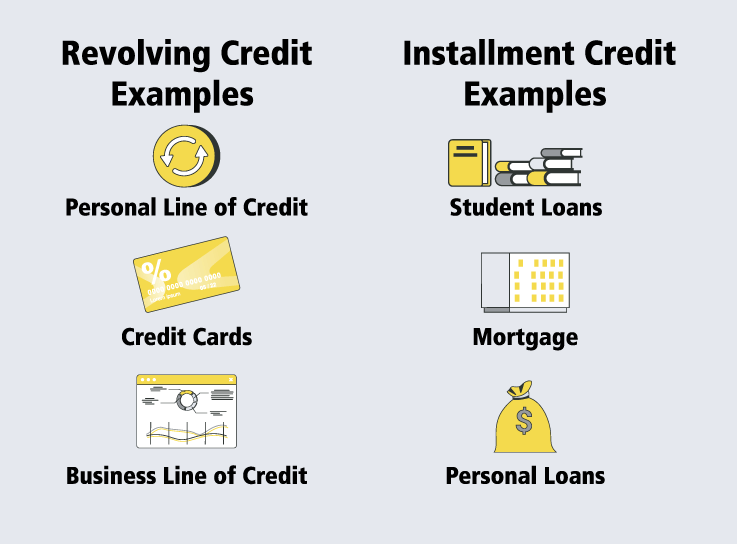

Should you’re beginning to construct your credit score historical past, you would possibly need to add a bank card or a credit-builder mortgage. There are some wonderful bank cards obtainable for individuals with honest credit score. You could have difficulties getting bank cards with wonderful phrases in case your credit score rating is on the low finish of the honest vary. In that case, you possibly can search for secured bank cards. A credit-building mortgage from a monetary establishment might be one other wonderful choice. The FICO rating acknowledges this type of mortgage as an installment mortgage. Subsequently that additionally affords you a slight enhance within the credit score combine class of your credit score report.

Needless to say credit-building takes time. There is not a fast treatment to show your honest scores into distinctive ones. Nonetheless, there is not any unsuitable time to start practising good monetary habits that can show you how to construct your credit score.

Get a Mortgage With Truthful Credit score?

Suppose you continue to need to get a mortgage with honest credit score. In that case, you possibly can contemplate the next methods earlier than making use of for a private mortgage to boost your probabilities of getting authorized even with a good credit score rating:

Prequalify for the mortgage:

As step one, you possibly can verify whether or not a lender affords prequalification when you’re not sure of your eligibility for a mortgage with that lender. Doing this can forestall additional injury to your credit score rating earlier than making use of.

Discover a co-signer:

Though a co-signer shares the identical threat and accountability in your mortgage, they could make it easier so that you can qualify with unhealthy or honest credit score. A co-signer with good or wonderful credit score can enhance your total creditworthiness.

Cut back your money owed:

Along with your credit score rating, many lenders additionally contemplate your debt-to-income ratio. Earlier than submitting a mortgage software, attempt to repay your bank card debt to enhance your credibility within the eyes of potential lenders.

Borrow out of your present lender:

Suppose you may have a historical past of constructing on-time funds in your accounts. In that case, your present lender could perceive your credit score standing higher no matter your credit score rating.

Truthful Credit score Vs. Good Credit score

Whether or not it’s FICO or VantageScore credit score rating scale, honest and good credit score are subsequent to one another. Nonetheless, your borrowing alternatives and monetary challenges can considerably differ between the 2 credit score rating ranges.

Your credit score rating is without doubt one of the easiest methods a possible lender can verify your creditworthiness. Usually, debtors with good or wonderful credit score are much less prone to fall behind on their funds. Because of this, you are extra prone to be authorized for a mortgage when you’ve got a excessive credit score rating as a result of it reveals you’re a low-risk shopper. You might also be eligible for higher bank card rewards with a very good credit score rating, reminiscent of substantial money affords and elevated credit score limits. Moreover, a very good credit score rating over honest could make renting a home or house simpler. Landlords verify your credit score to judge your probability of paying lease on time.

Conclusion

Figuring out the place you fall on the credit score rating is essential to make higher credit score selections. Usually, lenders would require you to have a credit score rating that’s not less than honest to approve a mortgage software. So, you shouldn’t view your honest credit score rating as a horrible factor. Having a rating of round 630 is considerably higher than having low credit score regarding your monetary choices, however this is not the place it is best to cease. You can also make some extent to often verify your credit score rating to seek out any errors or inaccuracies which will hurt your rating and produce it down. Since your scores are usually not unhealthy or poor, you possibly can benefit from the perks of a very good credit score rating by simply placing slightly effort into elevating your credit score rating.

Having a good credit score rating is best than having low credit score however actually not as nice as having a very good credit score rating. In case your credit score rating falls underneath the honest rating bracket, you may need fewer monetary alternatives obtainable. Work on constructing your credit score rating till you may have good or wonderful credit score. You will achieve entry to decrease rates of interest, higher bank cards, and extra.

To keep away from making unhealthy monetary selections and know your obtainable credit score choices, it is best to perceive the place your credit score rating vary falls. On this article, let’s be taught what a good credit score rating is, the way it could influence your monetary state of affairs, and what steps you possibly can take to enhance it.

What’s a Truthful Credit score Rating?

A good credit score rating is a three-digit quantity that falls into the honest rating vary of the credit-scoring mannequin used to calculate it. Quite a few corporations use completely different credit score scoring fashions to calculate your credit score scores. What honest credit score means largely is determined by the credit score scores you contemplate and the corporate that calculated them.

FICO and VantageScore are the 2 standard credit score scoring fashions that use completely different formulation to find out a credit score rating. The credit score scores underneath each fashions fall on a scale of 300 to 850. You might solely see just a few distinctions between the scores obtained from VantageScore and FICO. Usually, an individual with a good FICO rating may also have a good rating from VantageScore.

FICO VantageScore 4.0 Poor: 300 to 579 Dangerous: 300 to 600 Truthful: 580 to 669 Truthful: 601 to 660 Good: 670 to 739 Good: 661 to 780 Excellent: 740 to 799 Not Obtainable Distinctive: 800 to 850 Glorious: 781 to 850

What’s a Truthful FICO Rating?

In keeping with FICO, a good credit score rating is a credit score rating starting from 580 to 669. FICO scores are essentially the most extensively used credit score scores, with 90% of high lenders utilizing them when making lending selections.

When you’ve got a FICO rating between 580 to 669, your rating is taken into account under the common U.S. shopper rating. Many lenders will nonetheless approve loans with this rating, however there are probabilities that your rates of interest are on the upper aspect. Nonetheless, a rating within the mid-660s might get you a mortgage with comparatively higher charges than a good credit score rating within the 500s would.

What’s a Truthful VantageScore?

A good rating, as per VantageScore, ranges from 601 to 660. The three main credit score bureaus, Equifax, Experian, and TransUnion, created the VantageScore credit score scoring mannequin in March 2006 to compete with the FICO rating produced by Truthful Isaac Corp. (FICO).

Is Truthful Credit score Good?

The common credit score rating in the US is 716, which falls within the FICO mannequin’s good credit score vary. Since your FICO rating, when you’ve got honest credit score, will likely be between 580 and 669, it is decrease than the nationwide common rating. Your credit score rating is neither good nor unhealthy when you’ve got honest credit score. As a result of it falls someplace within the center, a good credit score rating is often known as common. Usually, these with credit score scores of 660 or larger are thought-about to be low-risk debtors by lenders. Then again, these with credit score scores under 660 may need a decrease likelihood of getting loans with higher phrases.

Contemplate your honest credit score rating as a necessary path resulting in good credit score. As you show wholesome monetary habits, you would possibly see a lift in your credit score rating. Moreover, you will know what it takes to boost your rating when you perceive the credit score rating ranges and the methodology used to generate them.

How Does a Truthful Credit score Rating Work?

Your credit score rating is a big three-digit quantity decided by the credit score historical past recorded in your credit score experiences. Lenders use it to evaluate your creditworthiness, how seemingly you will pay again your loans on time, and to determine whether or not or to not lend you cash. Debtors typically desire a good or wonderful rating. It is believed that the upper your rating, the higher your probabilities of getting authorized for a mortgage and securing a low annual proportion price (APR).

In case your credit score rating is honest, lenders would in all probability contemplate you a subprime borrower – somebody who will discover it difficult to repay their money owed. You might typically face refusals for a mortgage, bank card, or one other sort of credit score. Even if you’re accepted, some lenders would possibly cost a better APR for a borrower with honest credit score than somebody with robust credit score. Over the mortgage time period, your honest credit standing might value you lots of and even hundreds of {dollars}. So, given an opportunity, it is best to at all times attempt to enhance your credit score scores.

Enhance Your Truthful Credit score Rating

Though you is likely to be eligible for loans with honest credit score, elevating your rating might show you how to receive extra favorable mortgage phrases. You should utilize the next 4 steps to extend your honest credit score rating:

1. Handle Credit score Responsibly

There are numerous methods to indicate lenders that you’re a accountable borrower. Goal to make your funds on time every month to reveal to lenders that you simply adjust to the phrases of your mortgage settlement. Making late funds or skipping funds can decrease your credit score rating as a result of your fee historical past accounts for 35% of your credit score rating.

Your credit score utilization ratio is the ratio of credit score you may have used along with your complete obtainable credit score. It’s best to goal 30% or much less of your obtainable per account to take care of a wholesome credit score profile. As an example, in case your credit score restrict is $2,000, your month-to-month steadiness should not exceed $600. You may Attempt to maintain your utilization ratio even decrease if you wish to velocity up enhancing your credit score scores. This technique may also helps with maintain your debt in verify.

2. Constantly Monitor Your Credit score Report

Often reviewing your credit score experiences can help in guaranteeing the accuracy of the information reported to the credit score bureaus used to find out your credit score rating. AnnualCreditReport.com affords free copies of your credit score experiences from the three essential credit score bureaus: TransUnion, Equifax®, and Experian.

3. Keep away from exhausting inquiries from bank card functions

A excessive variety of credit score accounts opened shortly might decrease your score. Credit score scoring programs consider current inquiries. Once you apply for a bank card, the lender conducts a tough inquiry and punctiliously opinions your credit score report. With every exhausting inquiry, your credit score rating might be diminished by two to 5 factors. Making use of for bank cards you do not want or too many playing cards inside a brief interval can take your scores from honest to poor credit score vary. To keep away from having too many exhausting inquiries in your credit score document, solely apply for a bank card as soon as each 4 to 6 months.

4. Use Credit score Builder borrowing choices:

Should you’re beginning to construct your credit score historical past, you would possibly need to add a bank card or a credit-builder mortgage. There are some wonderful bank cards obtainable for individuals with honest credit score. You could have difficulties getting bank cards with wonderful phrases in case your credit score rating is on the low finish of the honest vary. In that case, you possibly can search for secured bank cards. A credit-building mortgage from a monetary establishment might be one other wonderful choice. The FICO rating acknowledges this type of mortgage as an installment mortgage. Subsequently that additionally affords you a slight enhance within the credit score combine class of your credit score report.

Needless to say credit-building takes time. There is not a fast treatment to show your honest scores into distinctive ones. Nonetheless, there is not any unsuitable time to start practising good monetary habits that can show you how to construct your credit score.

Get a Mortgage With Truthful Credit score?

Suppose you continue to need to get a mortgage with honest credit score. In that case, you possibly can contemplate the next methods earlier than making use of for a private mortgage to boost your probabilities of getting authorized even with a good credit score rating:

Prequalify for the mortgage:

As step one, you possibly can verify whether or not a lender affords prequalification when you’re not sure of your eligibility for a mortgage with that lender. Doing this can forestall additional injury to your credit score rating earlier than making use of.

Discover a co-signer:

Though a co-signer shares the identical threat and accountability in your mortgage, they could make it easier so that you can qualify with unhealthy or honest credit score. A co-signer with good or wonderful credit score can enhance your total creditworthiness.

Cut back your money owed:

Along with your credit score rating, many lenders additionally contemplate your debt-to-income ratio. Earlier than submitting a mortgage software, attempt to repay your bank card debt to enhance your credibility within the eyes of potential lenders.

Borrow out of your present lender:

Suppose you may have a historical past of constructing on-time funds in your accounts. In that case, your present lender could perceive your credit score standing higher no matter your credit score rating.

Truthful Credit score Vs. Good Credit score

Whether or not it’s FICO or VantageScore credit score rating scale, honest and good credit score are subsequent to one another. Nonetheless, your borrowing alternatives and monetary challenges can considerably differ between the 2 credit score rating ranges.

Your credit score rating is without doubt one of the easiest methods a possible lender can verify your creditworthiness. Usually, debtors with good or wonderful credit score are much less prone to fall behind on their funds. Because of this, you are extra prone to be authorized for a mortgage when you’ve got a excessive credit score rating as a result of it reveals you’re a low-risk shopper. You might also be eligible for higher bank card rewards with a very good credit score rating, reminiscent of substantial money affords and elevated credit score limits. Moreover, a very good credit score rating over honest could make renting a home or house simpler. Landlords verify your credit score to judge your probability of paying lease on time.

Conclusion

Figuring out the place you fall on the credit score rating is essential to make higher credit score selections. Usually, lenders would require you to have a credit score rating that’s not less than honest to approve a mortgage software. So, you shouldn’t view your honest credit score rating as a horrible factor. Having a rating of round 630 is considerably higher than having low credit score regarding your monetary choices, however this is not the place it is best to cease. You can also make some extent to often verify your credit score rating to seek out any errors or inaccuracies which will hurt your rating and produce it down. Since your scores are usually not unhealthy or poor, you possibly can benefit from the perks of a very good credit score rating by simply placing slightly effort into elevating your credit score rating.