When you will have a line of credit score, there are two varieties of compensation construction: revolving credit score and installment credit score. Each types of credit score are secured or unsecured. A secured installment mortgage is extra widespread.

Revolving Credit score: Your lender advances a set credit score restrict that you simply use all of sudden or partly. You borrow the cash, spend it, repay it, and spend it once more with revolving credit score.

Installment Credit score: Your lender advances the entire quantity, and also you repay it with scheduled, periodic funds. You regularly scale back the principal, which ends up in paying off the unique quantity.

What Is Revolving Credit score?

A line of credit score (LOC) or bank card is the commonest revolving credit score kind. While you make funds on this credit score line, your credit score restrict doesn’t change. You possibly can borrow from it as a lot as you need if you don’t exceed the unique restrict. There is not a set cost plan as a result of you aren’t borrowing a lump sum. You possibly can borrow as much as your credit score restrict. You will pay extra for this flexibility, increased rates of interest, and presumably a decrease borrowing quantity. You will solely be charged for the quantity you withdraw each month, not all the credit score restrict.

What Is Installment Credit score?

A automotive mortgage or mortgage is the commonest type of this kind. Installment credit score is an account with a predetermined size, and shutting date, typically known as the mortgage time period. the quantity of your month-to-month funds and the way lengthy it’s essential make these funds. If it’s essential borrow extra money, you may fill out one other software.

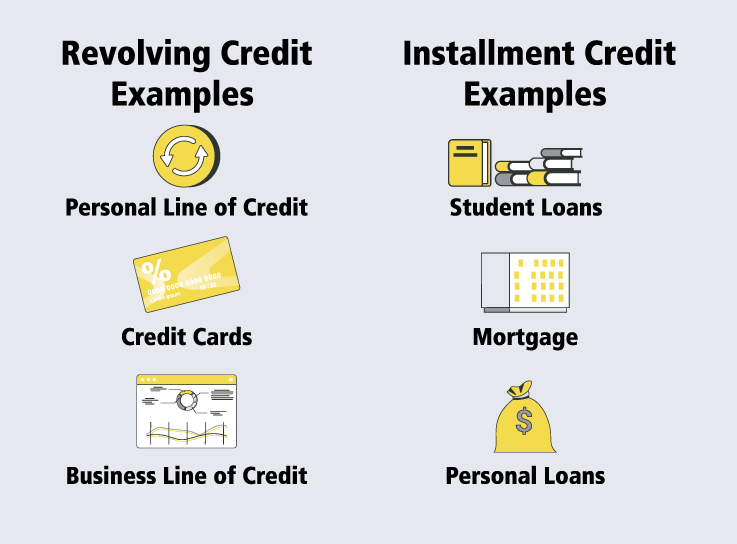

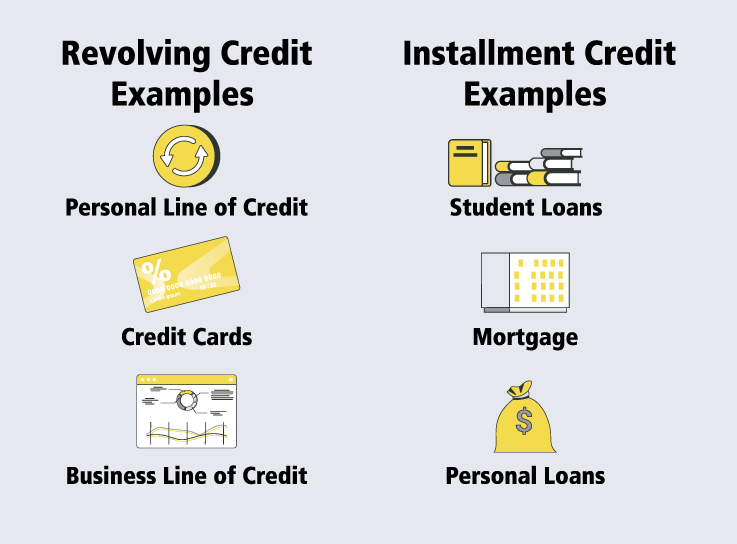

Examples of Revolving Credit score and Installment Credit score

Benefits of Revolving Credit score

A revolving line of credit score has professionals and cons that must be thought-about. This is the way it stacks up in opposition to installment credit score.

Versatile Borrowing

You get the utmost quantity obtainable everytime you want it. Even if you happen to do not want it proper now, you may have a chunk of thoughts. There is no must undergo a prolonged approval course of if you happen to want additional money. You employ what you want on the time.

Covers Monetary Tough Spots

Even if in case you have a great credit score rating, your money move will be uneven. Suppose you’re a salesperson who sells automobiles and solely makes cash from a handful of gross sales a 12 months. A line of credit score will aid you maintain present in your monetary obligations through the months when your money move is low.

You additionally would possibly make most of your cash over the past fiscal quarter if you happen to personal a seasonal enterprise. Your revolving credit score line will help you rent wanted workers, figuring out that you’re going to meet the added prices later.

Safe Financing Possibility

In case you want a decrease rate of interest, you could possibly apply for a secured line of credit score possibility. You should utilize varieties of collateral to safe your revolving credit score. Listed below are some examples:

- Actual property

- Gear

- Autos

- Inventory portfolio

- Different priceless belongings

Compensation Flexibility

You will have the flexibleness to determine how and when your credit score line is repaid. Citing the instance of the seasonal enterprise, after your busy season, you will have loads of money readily available. You possibly can postpone compensation till your money move helps it.

Disadvantages of Revolving Line of Credit score

Larger Curiosity Charges

As a result of revolving traces of credit score are versatile, lenders take into account them to hold extra threat. Due to this, you may probably encounter increased rates of interest than installment credit score. In case you’re seeking to make a big buy, take into account an installment mortgage as a substitute.

Temptation

People overspend once they have revolving credit score. Take a look at these bank card debt stats. There’s additionally an inclination to pay the minimal quantity each month as a result of it’s so small, spending a substantial quantity on curiosity over time.

Decrease Credit score Limits

As talked about above, revolving credit score is taken into account increased threat main lenders to approve you for decrease credit score limits. In case you want substantial financing, this line of credit score possibility isn’t for you.

Surprising Adjustable Phrases

The phrases of use for revolving traces of credit score, together with your rate of interest, can change with little discover. You will not have to simply accept any new phrases, however any new phrases legally bind you if you happen to proceed to make use of that credit score. Sadly, your solely choice to not settle for these new phrases is to pay your full stability and cancel that credit score line.

Benefits of Installment Credit score

Installment credit score has professionals and cons that it’s essential take into account. This is the way it stacks up in opposition to a revolving line of credit score.

Predictable Funds

Month-to-month funds set on the similar quantity present predictability in your funds. In comparison with revolving credit score, Installment credit score has a set time period, rate of interest, and usually, the identical month-to-month cost.

Bigger Mortgage limits

As a result of lenders take into account any such credit score much less dangerous, you’ll entry increased mortgage limits than with revolving credit score if you happen to can meet the necessities. In fact, it doesn’t suggest that you simply will not be capable to apply for a smaller mortgage quantity. You will get a mortgage for a couple of thousand {dollars} if that is all you want.

Decrease Borrowing Prices

By way of rates of interest, installment credit score will be inexpensive. Lenders provide decrease rates of interest which can value much less over time. Some individuals use installment credit score to repay their revolving credit score when the rate of interest is decrease.

Make Massive Purchases

One of many widespread options of installment credit score is its versatility. As soon as accepted, you should use it to pay for a significant buy, corresponding to a automotive. You may also use it to buy a house and pay later in small quantities for 15 to 30 years.

Disadvantages of Installment Credit score

Powerful to Qualify

Due to the decrease rates of interest, lenders have extra stringent necessities so that you can qualify. They are going to take into account your revenue, credit score historical past, and different excellent debt. Most revolving credit score traces are usually extra lenient of their lending practices, notably for higher-risk debtors.

Prepayment Penalties

Some lending agreements won’t help you repay your credit score line early, so you have to learn the effective print. You will be charged a considerable payment for paying greater than the required quantity every month or settle the debt solely.

Double Dipping

As talked about earlier than, you should use installment credit score to repay your revolving credit score if you happen to discover a decrease rate of interest. However, it’s important to commit to not use your revolving credit score. Operating up new balances and the month-to-month funds required by your installment credit score will put extra stress in your funds.

Locked Phrases

As a result of the phrases of your installment credit score are decided earlier than you shut, you will be unable to renegotiate. The cost schedule, rate of interest, and phrases are set in stone. In case your monetary scenario modifications or your credit score improves, you’ll have to refinance to get a greater rate of interest.

How Can You Construct Credit score With Installment and Revolving Credit score?

How you utilize traces of credit score can actually damage your credit score rating if it’s not used correctly, however it may be nice in your rating if you happen to handle each your credit score combine and your credit score utilization. Comply with the following tips to enhance and construct your credit score quick.

Do not spend it all of sudden: The way you handle your credit score stability is a good portion of your credit score rating. Your credit score utilization ratio, how a lot you owe in comparison with your credit score stability, is 30% of your FICO rating. Preserve your ratio under one-third of your restrict, and your credit score will enhance.

Pay payments on time: Make all of your month-to-month funds on time as a result of your cost historical past is the largest consider your credit score rating. In case you miss any funds, your rating will scale back considerably.

Use several types of credit score: Lenders really feel extra assured if you happen to present them that you may handle completely different sorts of credit score. Having each installment and revolving credit score will profit your credit score rating.

Don’t open too many accounts directly: Having completely different credit score sorts is a profit, however you do not need to open all of them directly. Watch out to not open too many accounts inside a couple of months or perhaps a 12 months. One of the best technique is to construct credit score steadily over time.

Proceed utilizing your credit score: Your rating will improve if you happen to use credit score over an prolonged interval.

Make Educated Choices About Your Credit score

Figuring out the distinction between revolving and installment credit score means that you can make higher monetary selections. Many borrowing choices can be found, whether or not your purpose is to save cash on curiosity, get by way of robust occasions, construct your credit score, or repay your debt. However, earlier than you apply for any credit score, be mindful the way it will have an effect on you. Doing so will help you handle your funds and set you up for achievement.

When you will have a line of credit score, there are two varieties of compensation construction: revolving credit score and installment credit score. Each types of credit score are secured or unsecured. A secured installment mortgage is extra widespread.

Revolving Credit score: Your lender advances a set credit score restrict that you simply use all of sudden or partly. You borrow the cash, spend it, repay it, and spend it once more with revolving credit score.

Installment Credit score: Your lender advances the entire quantity, and also you repay it with scheduled, periodic funds. You regularly scale back the principal, which ends up in paying off the unique quantity.

What Is Revolving Credit score?

A line of credit score (LOC) or bank card is the commonest revolving credit score kind. While you make funds on this credit score line, your credit score restrict doesn’t change. You possibly can borrow from it as a lot as you need if you don’t exceed the unique restrict. There is not a set cost plan as a result of you aren’t borrowing a lump sum. You possibly can borrow as much as your credit score restrict. You will pay extra for this flexibility, increased rates of interest, and presumably a decrease borrowing quantity. You will solely be charged for the quantity you withdraw each month, not all the credit score restrict.

What Is Installment Credit score?

A automotive mortgage or mortgage is the commonest type of this kind. Installment credit score is an account with a predetermined size, and shutting date, typically known as the mortgage time period. the quantity of your month-to-month funds and the way lengthy it’s essential make these funds. If it’s essential borrow extra money, you may fill out one other software.

Examples of Revolving Credit score and Installment Credit score

Benefits of Revolving Credit score

A revolving line of credit score has professionals and cons that must be thought-about. This is the way it stacks up in opposition to installment credit score.

Versatile Borrowing

You get the utmost quantity obtainable everytime you want it. Even if you happen to do not want it proper now, you may have a chunk of thoughts. There is no must undergo a prolonged approval course of if you happen to want additional money. You employ what you want on the time.

Covers Monetary Tough Spots

Even if in case you have a great credit score rating, your money move will be uneven. Suppose you’re a salesperson who sells automobiles and solely makes cash from a handful of gross sales a 12 months. A line of credit score will aid you maintain present in your monetary obligations through the months when your money move is low.

You additionally would possibly make most of your cash over the past fiscal quarter if you happen to personal a seasonal enterprise. Your revolving credit score line will help you rent wanted workers, figuring out that you’re going to meet the added prices later.

Safe Financing Possibility

In case you want a decrease rate of interest, you could possibly apply for a secured line of credit score possibility. You should utilize varieties of collateral to safe your revolving credit score. Listed below are some examples:

- Actual property

- Gear

- Autos

- Inventory portfolio

- Different priceless belongings

Compensation Flexibility

You will have the flexibleness to determine how and when your credit score line is repaid. Citing the instance of the seasonal enterprise, after your busy season, you will have loads of money readily available. You possibly can postpone compensation till your money move helps it.

Disadvantages of Revolving Line of Credit score

Larger Curiosity Charges

As a result of revolving traces of credit score are versatile, lenders take into account them to hold extra threat. Due to this, you may probably encounter increased rates of interest than installment credit score. In case you’re seeking to make a big buy, take into account an installment mortgage as a substitute.

Temptation

People overspend once they have revolving credit score. Take a look at these bank card debt stats. There’s additionally an inclination to pay the minimal quantity each month as a result of it’s so small, spending a substantial quantity on curiosity over time.

Decrease Credit score Limits

As talked about above, revolving credit score is taken into account increased threat main lenders to approve you for decrease credit score limits. In case you want substantial financing, this line of credit score possibility isn’t for you.

Surprising Adjustable Phrases

The phrases of use for revolving traces of credit score, together with your rate of interest, can change with little discover. You will not have to simply accept any new phrases, however any new phrases legally bind you if you happen to proceed to make use of that credit score. Sadly, your solely choice to not settle for these new phrases is to pay your full stability and cancel that credit score line.

Benefits of Installment Credit score

Installment credit score has professionals and cons that it’s essential take into account. This is the way it stacks up in opposition to a revolving line of credit score.

Predictable Funds

Month-to-month funds set on the similar quantity present predictability in your funds. In comparison with revolving credit score, Installment credit score has a set time period, rate of interest, and usually, the identical month-to-month cost.

Bigger Mortgage limits

As a result of lenders take into account any such credit score much less dangerous, you’ll entry increased mortgage limits than with revolving credit score if you happen to can meet the necessities. In fact, it doesn’t suggest that you simply will not be capable to apply for a smaller mortgage quantity. You will get a mortgage for a couple of thousand {dollars} if that is all you want.

Decrease Borrowing Prices

By way of rates of interest, installment credit score will be inexpensive. Lenders provide decrease rates of interest which can value much less over time. Some individuals use installment credit score to repay their revolving credit score when the rate of interest is decrease.

Make Massive Purchases

One of many widespread options of installment credit score is its versatility. As soon as accepted, you should use it to pay for a significant buy, corresponding to a automotive. You may also use it to buy a house and pay later in small quantities for 15 to 30 years.

Disadvantages of Installment Credit score

Powerful to Qualify

Due to the decrease rates of interest, lenders have extra stringent necessities so that you can qualify. They are going to take into account your revenue, credit score historical past, and different excellent debt. Most revolving credit score traces are usually extra lenient of their lending practices, notably for higher-risk debtors.

Prepayment Penalties

Some lending agreements won’t help you repay your credit score line early, so you have to learn the effective print. You will be charged a considerable payment for paying greater than the required quantity every month or settle the debt solely.

Double Dipping

As talked about earlier than, you should use installment credit score to repay your revolving credit score if you happen to discover a decrease rate of interest. However, it’s important to commit to not use your revolving credit score. Operating up new balances and the month-to-month funds required by your installment credit score will put extra stress in your funds.

Locked Phrases

As a result of the phrases of your installment credit score are decided earlier than you shut, you will be unable to renegotiate. The cost schedule, rate of interest, and phrases are set in stone. In case your monetary scenario modifications or your credit score improves, you’ll have to refinance to get a greater rate of interest.

How Can You Construct Credit score With Installment and Revolving Credit score?

How you utilize traces of credit score can actually damage your credit score rating if it’s not used correctly, however it may be nice in your rating if you happen to handle each your credit score combine and your credit score utilization. Comply with the following tips to enhance and construct your credit score quick.

Do not spend it all of sudden: The way you handle your credit score stability is a good portion of your credit score rating. Your credit score utilization ratio, how a lot you owe in comparison with your credit score stability, is 30% of your FICO rating. Preserve your ratio under one-third of your restrict, and your credit score will enhance.

Pay payments on time: Make all of your month-to-month funds on time as a result of your cost historical past is the largest consider your credit score rating. In case you miss any funds, your rating will scale back considerably.

Use several types of credit score: Lenders really feel extra assured if you happen to present them that you may handle completely different sorts of credit score. Having each installment and revolving credit score will profit your credit score rating.

Don’t open too many accounts directly: Having completely different credit score sorts is a profit, however you do not need to open all of them directly. Watch out to not open too many accounts inside a couple of months or perhaps a 12 months. One of the best technique is to construct credit score steadily over time.

Proceed utilizing your credit score: Your rating will improve if you happen to use credit score over an prolonged interval.

Make Educated Choices About Your Credit score

Figuring out the distinction between revolving and installment credit score means that you can make higher monetary selections. Many borrowing choices can be found, whether or not your purpose is to save cash on curiosity, get by way of robust occasions, construct your credit score, or repay your debt. However, earlier than you apply for any credit score, be mindful the way it will have an effect on you. Doing so will help you handle your funds and set you up for achievement.