Bank card fraud is a critical and prevalent downside immediately. In response to a 2016 research by ACI World Extensive, a staggering 46 p.c of Individuals skilled bank card fraud prior to now 5 years. Bank card fraud happens when an individual illegally makes use of another person’s credit score or debit card to make transactions and withdraw unauthorized funds from their account. It’s typically dedicated by scammers who implement deceitful strategies to achieve entry to your private data and use it to hack into your accounts. This crime wreaks havoc on victims’ credit score scores and might take months to restore the harm. It’s extremely vital to remain conscious of dangers and learn to keep away from bank card fraud by taking these precautions.

Take Warning When Making On-line Funds

When getting into your bank card data on-line, it’s vital to be particularly cautious. When you’re on a web site that isn’t safe, you need to chorus from getting into any of your data. An unsecured web site signifies that it isn’t utilizing correct encryption methods and the admin won’t be who they are saying they’re. You’ll be able to simply inform if a web site is safe by the padlock to the left of the URL. It’s also possible to decide in the event you’re utilizing a safe web site as a result of it should have the letters HTTPS, not simply HTTP, in entrance of the online deal with. If a web site doesn’t have each these traits, it isn’t safe, and a notification within the search bar could warn you.

Be Cautious When Giving Out Your Credit score Card Data over the Cellphone

Many companies settle for bank card funds over the telephone. It’s vital, nevertheless, to stay cautious when participating in a mobile transaction. Giving out your bank card data over the telephone is likely one of the commonest methods to fall sufferer to bank card fraud. It is because it’s simple for fraudulent scammers to mimic an organization and steal your credit score data, because it’s tougher to show their id. These scammers typically name you and ask for data, slightly than you contacting them to make a cost. Until you provoke the transaction, or confirmed the particular person you’re speaking to is reliable, you need to keep away from giving your bank card quantity over the telephone.

Be Conscious of Phishing

Phishing refers to deceitful makes an attempt to lure folks into giving freely their private data, akin to passwords or bank card particulars. The scammer reaches out to the sufferer by e mail or a type of prompt messaging, they usually direct victims to an illegitimate web site to enter their data. To be protected, you need to enter your data instantly on a enterprise’s web site, slightly than clicking on the hyperlink via an e mail. You’ll be able to typically inform in the event you’ve acquired a phishing e mail as a result of it should request you ship them delicate data over e mail or enter it into an connected hyperlink. A majority of legit firms don’t ship unsolicited requests for delicate data. Different frequent traits of phishing makes an attempt embrace spelling errors, unsolicited attachments, the absence of a site e mail, and generic salutations.

Maintain Your Private Data Personal

To stop bank card fraud, you need to keep away from giving out your private data as a lot as attainable—even to folks you belief. Fraud dedicated by somebody that the sufferer is aware of, or “acquainted fraud,” is pretty frequent. This crime is commonly perpetrated by a father or mother, little one, sibling, or buddy of the sufferer whom they thought they might belief with their data. Whereas no person needs to consider that somebody they think about might betray them, it’s higher to be protected than sorry; keep away from sharing your bank card data or social safety quantity.

Use a Digital Personal Community When Utilizing Public Wi-Fi

The following time you ask for the Wi-Fi password in a public place, think about using a digital non-public community (VPN). Public Wi-Fi could make you extraordinarily weak to hackers who need to steal your bank card data. It is because anybody utilizing the identical public community that you simply’re linked to can entry the information being transferred between your machine and the web router. One other threat is that somebody might arrange a Wi-Fi community with an identical title to the general public one to acquire your data after you connect with it. To lower your probabilities of falling sufferer to bank card fraud, you need to at all times use a VPN when logging onto public Wi-Fi. The programming allows you to safely use shared public Wi-Fi by encrypting your information on the sending finish, so hackers can’t entry it.

Maintain a Shut Eye on Your Accounts and Credit score Report

Maintaining a tally of your credit score report and rating will provide help to catch bank card fraud early on. It is best to examine your credit score report not less than as soon as per 12 months to make sure the information in your credit score profile is correct. To obtain warnings about modifications to your credit score, and uncover circumstances of fraudulent exercise, you may also enlist the assistance of a credit score monitoring service.

Enter Your Credit score Card Data Manually

Manually getting into your bank card data each time you make a web based buy generally is a problem. It could, nevertheless, assist lower your probabilities of bank card fraud. While you save your bank card data on a incessantly used web site, you place your belief within the firm’s cybersecurity safety. If it seems that their safety is weak, they usually have a knowledge breach, your bank card particulars could possibly be uncovered to hackers desperate to steal your data. It’s a lot safer to take the additional time to manually enter your bank card information every time you make a purchase order.

Use a Chip Reader or Permit Cell Pay

Utilizing a chip reader or cell pay will assist defend you from skimming units. Skimmers positioned on card-reading units on ATMs, gasoline stations, or registers at shops permit hackers to acquire bank card data by “skimming” the information out of your card’s magnetic strip as you scan it. Choose to make use of cell funds to assist eradicate this threat, since you received’t have to slip your card via a scanning machine probably outfitted with a skimmer. When you’re unable to make use of cell pay, you may also use a chip reader to cut back the chance. Chip readers are safer as a result of they learn the knowledge in your bank card’s chip slightly than the magnetic strip.

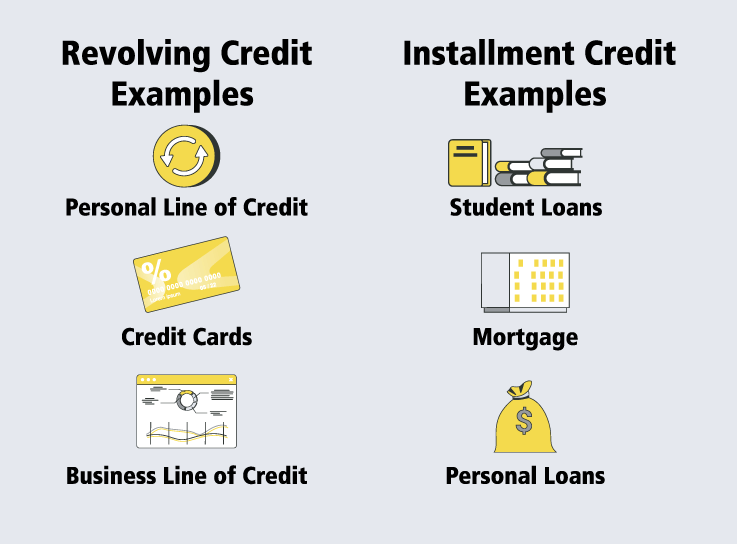

When you’ve fallen sufferer to bank card fraud and expertise hassle acquiring a mortgage because of your broken credit score rating, Money 1 Loans can assist. We provide a various array of mortgage choices for folks with credit score scores on the decrease finish of the spectrum, together with Arizona and Nevada title loans, and automobile registration loans. We additionally provide installment, private, and title fairness loans, and settle for all types of credit score.

Bank card fraud is a critical and prevalent downside immediately. In response to a 2016 research by ACI World Extensive, a staggering 46 p.c of Individuals skilled bank card fraud prior to now 5 years. Bank card fraud happens when an individual illegally makes use of another person’s credit score or debit card to make transactions and withdraw unauthorized funds from their account. It’s typically dedicated by scammers who implement deceitful strategies to achieve entry to your private data and use it to hack into your accounts. This crime wreaks havoc on victims’ credit score scores and might take months to restore the harm. It’s extremely vital to remain conscious of dangers and learn to keep away from bank card fraud by taking these precautions.

Take Warning When Making On-line Funds

When getting into your bank card data on-line, it’s vital to be particularly cautious. When you’re on a web site that isn’t safe, you need to chorus from getting into any of your data. An unsecured web site signifies that it isn’t utilizing correct encryption methods and the admin won’t be who they are saying they’re. You’ll be able to simply inform if a web site is safe by the padlock to the left of the URL. It’s also possible to decide in the event you’re utilizing a safe web site as a result of it should have the letters HTTPS, not simply HTTP, in entrance of the online deal with. If a web site doesn’t have each these traits, it isn’t safe, and a notification within the search bar could warn you.

Be Cautious When Giving Out Your Credit score Card Data over the Cellphone

Many companies settle for bank card funds over the telephone. It’s vital, nevertheless, to stay cautious when participating in a mobile transaction. Giving out your bank card data over the telephone is likely one of the commonest methods to fall sufferer to bank card fraud. It is because it’s simple for fraudulent scammers to mimic an organization and steal your credit score data, because it’s tougher to show their id. These scammers typically name you and ask for data, slightly than you contacting them to make a cost. Until you provoke the transaction, or confirmed the particular person you’re speaking to is reliable, you need to keep away from giving your bank card quantity over the telephone.

Be Conscious of Phishing

Phishing refers to deceitful makes an attempt to lure folks into giving freely their private data, akin to passwords or bank card particulars. The scammer reaches out to the sufferer by e mail or a type of prompt messaging, they usually direct victims to an illegitimate web site to enter their data. To be protected, you need to enter your data instantly on a enterprise’s web site, slightly than clicking on the hyperlink via an e mail. You’ll be able to typically inform in the event you’ve acquired a phishing e mail as a result of it should request you ship them delicate data over e mail or enter it into an connected hyperlink. A majority of legit firms don’t ship unsolicited requests for delicate data. Different frequent traits of phishing makes an attempt embrace spelling errors, unsolicited attachments, the absence of a site e mail, and generic salutations.

Maintain Your Private Data Personal

To stop bank card fraud, you need to keep away from giving out your private data as a lot as attainable—even to folks you belief. Fraud dedicated by somebody that the sufferer is aware of, or “acquainted fraud,” is pretty frequent. This crime is commonly perpetrated by a father or mother, little one, sibling, or buddy of the sufferer whom they thought they might belief with their data. Whereas no person needs to consider that somebody they think about might betray them, it’s higher to be protected than sorry; keep away from sharing your bank card data or social safety quantity.

Use a Digital Personal Community When Utilizing Public Wi-Fi

The following time you ask for the Wi-Fi password in a public place, think about using a digital non-public community (VPN). Public Wi-Fi could make you extraordinarily weak to hackers who need to steal your bank card data. It is because anybody utilizing the identical public community that you simply’re linked to can entry the information being transferred between your machine and the web router. One other threat is that somebody might arrange a Wi-Fi community with an identical title to the general public one to acquire your data after you connect with it. To lower your probabilities of falling sufferer to bank card fraud, you need to at all times use a VPN when logging onto public Wi-Fi. The programming allows you to safely use shared public Wi-Fi by encrypting your information on the sending finish, so hackers can’t entry it.

Maintain a Shut Eye on Your Accounts and Credit score Report

Maintaining a tally of your credit score report and rating will provide help to catch bank card fraud early on. It is best to examine your credit score report not less than as soon as per 12 months to make sure the information in your credit score profile is correct. To obtain warnings about modifications to your credit score, and uncover circumstances of fraudulent exercise, you may also enlist the assistance of a credit score monitoring service.

Enter Your Credit score Card Data Manually

Manually getting into your bank card data each time you make a web based buy generally is a problem. It could, nevertheless, assist lower your probabilities of bank card fraud. While you save your bank card data on a incessantly used web site, you place your belief within the firm’s cybersecurity safety. If it seems that their safety is weak, they usually have a knowledge breach, your bank card particulars could possibly be uncovered to hackers desperate to steal your data. It’s a lot safer to take the additional time to manually enter your bank card information every time you make a purchase order.

Use a Chip Reader or Permit Cell Pay

Utilizing a chip reader or cell pay will assist defend you from skimming units. Skimmers positioned on card-reading units on ATMs, gasoline stations, or registers at shops permit hackers to acquire bank card data by “skimming” the information out of your card’s magnetic strip as you scan it. Choose to make use of cell funds to assist eradicate this threat, since you received’t have to slip your card via a scanning machine probably outfitted with a skimmer. When you’re unable to make use of cell pay, you may also use a chip reader to cut back the chance. Chip readers are safer as a result of they learn the knowledge in your bank card’s chip slightly than the magnetic strip.

When you’ve fallen sufferer to bank card fraud and expertise hassle acquiring a mortgage because of your broken credit score rating, Money 1 Loans can assist. We provide a various array of mortgage choices for folks with credit score scores on the decrease finish of the spectrum, together with Arizona and Nevada title loans, and automobile registration loans. We additionally provide installment, private, and title fairness loans, and settle for all types of credit score.