There isn’t any one measurement suits all reply to what number of traces of credit score it’s best to have. The proper steadiness for you is dependent upon the necessities, your potential to pay them off, and the way you employ your line of credit score. Having two traces of credit score could possibly be too many if you cannot afford to make your funds or do not have plans to make use of it quickly.

A brand new line of credit score might enhance your credit score rating. Nevertheless, it’s best to by no means take out a further line of credit score except essential. Making use of for a number of traces of credit score in a brief interval will not be suggested, and having too many traces of credit score make you look dangerous to lenders.

How Many Traces of Credit score Do Individuals Have?

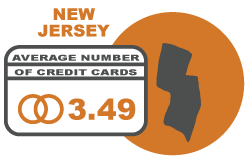

Whereas Individuals, on common, have practically 4 bank cards every, that is solely a nationwide common. FICO found that cardholders within the wonderful vary of credit score, scores 750 to 850, had three open accounts. That they had a complete of six traces of credit score in the event you embrace closed accounts.

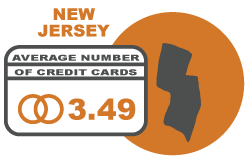

New Jersey residents have a mean 3.49 bank cards.

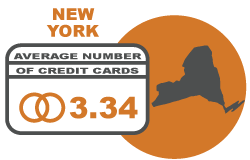

New York residents have a mean 3.34 bank cards.

Rhode Island residents have a mean 3.26 bank cards.

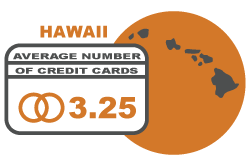

Hawaii residents have a mean 3.25 bank cards.

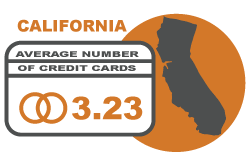

California residents have a mean 3.23 bank cards.

Do Traces of Credit score Have an effect on Your Credit score Rating?

What number of traces of credit score you’ve gotten does not straight have an effect on your credit score rating. Extra vital than the variety of credit score traces you’ve gotten is whether or not you pay on time and what number of your obtainable credit score you employ. Most individuals with wonderful FICO scores, 795 or increased, would not have late funds on their credit score stories. Additionally they solely use 7% of their credit score restrict. If you happen to’re considering of opening or closing a revolving line of credit score, hold these in thoughts:

Your Cost Historical past

How a lot credit score you employ and your cost historical past decide 65% of your FICO rating. Paying your credit score traces on time is much extra vital than what number of traces of credit score you’ve gotten. If you wish to construct your credit score rating quick – pay your credit score payments on time.

Your Credit score Utilization

How a lot of the credit score restrict you employ, known as the credit score utilization ratio, accounts for one-third of your credit score rating. Retaining your ratio under 30% might help you maximize your credit score rating.

If you happen to open a brand new line of credit score and enhance your total credit score line, it may assist construct your credit score rating by reducing your credit score utilization. It is vital to know that making use of for a brand new line of credit score leads to a tough credit score inquiry which may quickly drop your rating a couple of factors. You will wish to keep away from making use of for a number of credit score traces; spacing purposes six months aside will stop quite a few laborious inquiries from affecting your rating.

Your Credit score Historical past

The age of your line of credit score is crucial. Lenders and collectors wish to see steady and lengthy credit score histories. However having one outdated line of credit score that was appropriately managed will not be sufficient.

Your credit score rating is the common of all of the traces of credit score that you’ve. A ding to your credit score could also be value it in the event you shut a line of credit score if you really feel the rate of interest is just too excessive or the service is horrible. It is at all times value speaking along with your lender to see your choices earlier than closing your credit score line.

Your New Credit score Accounts

Just lately opened credit score accounts calculate 10% of your credit score rating. The brand new credit score may be detrimental to you you probably have a brief credit score historical past. As talked about earlier than, it’s best to wait no less than six months earlier than opening one other.

Your Credit score Combine

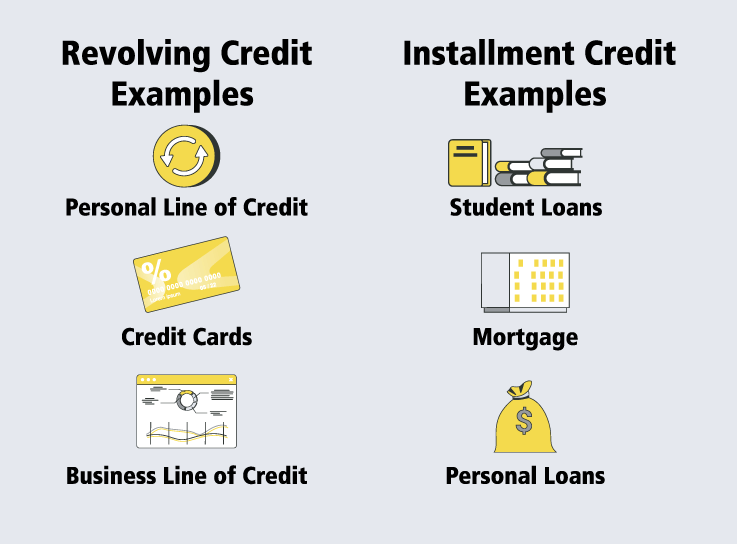

One other 10% of your FICO® rating is your credit score combine or quantity of credit score traces. The credit score bureaus contemplate your number of traces of credit score, retail accounts, and bank cards. It is pointless to have every sort of credit score, however lenders wish to see you handle a various vary of credit score traces.

Is It Good to Have A number of Traces of Credit score?

Sure, you possibly can have a number of traces of credit score at one time. Most individuals have a number of at a time. If you happen to presently have bank cards, a mortgage, pupil loans, and so on., you’ve gotten multiple line of credit score. There are execs to having a number of so long as you retain up with all funds.

Professionals

Your FICO® rating determines the quantity and number of loans you possibly can handle without delay. This is without doubt one of the most generally used credit score scores, and having a number of traces of credit score can increase it. FICO sees the number of loans as expertise with borrowing cash. You will not profit from a number of traces of credit score in the event you do not sustain with funds, have a excessive credit score utilization charge, and use unhealthy credit score practices.

Cons

Though having multiple line of credit score may be useful, it comes with potential dangers. When you’ve gotten a number of loans, you’re including further curiosity to your month-to-month bills. If in case you have excessive rates of interest, it may change into difficult to fulfill all cost obligations on time.With a number of traces of credit score to repay, it’s simpler to overlook to pay a invoice. This might negatively influence your credit score rating and have an effect on your probabilities of getting a long-term or short-term mortgage.If you happen to take out too many traces of credit score, FICO may even see this as you being in monetary bother.

Handle A number of Traces of Credit score

While you wish to construct your credit score, it is best to have no less than two open traces of credit score. Preserve your oldest credit score line open, and it’s best to be capable to get an improve after making funds on time for six months. There are various methods to handle your credit score line, so listed below are eventualities for one, two, and three or extra traces of credit score.

One Line of Credit score

One credit score account is widespread, particularly in the event you’re beginning or constructing from any monetary errors. If in case you have extra established credit score, chances are you’ll select to have a single line of credit score to keep away from any temptation of overspending or forgetting to make a cost. The one challenge with having just one credit score line is that you could be be leaving financial savings on the desk.

Two Traces of Credit score

If you haven’t any debt along with your two credit score traces, you possibly can use a pair of reward playing cards. One may provide cashback rewards, and the opposite may provide you with journey rewards or reductions at your favourite retailer. If in case you have debt or are making ready to make a big buy that might take months to resolve, it’s best to use a rewards card for on a regular basis spending and a 0% card for financing.

Three or Extra Traces of Credit score

Having a 3rd credit score line means that you can be extra opportunistic with particular presents and choose and select the very best phrases. If you happen to plan on paying in full, you possibly can choose in for the very best rewards card to your most important month-to-month purchases. You should utilize two core playing cards and complement with the very best preliminary presents obtainable. You can additionally use a few rewards playing cards with a 0% APR provide. However keep in mind, the extra traces of credit score you’ve gotten, the extra you will must handle these monetary obligations.

Select the Proper Variety of Credit score Traces

Increase As Your Credit score Grows

An important issue figuring out what number of traces of credit score it’s best to have, or can have, is your expertise. You will must ask your self you probably have established credit score or are you beginning out? The much less skilled or, the more serious your credit score rating is, the less choices you will have and the extra you will must give attention to one credit score line and handle it responsibly.

Completely Handle Your One Card

If in case you have good or a bad credit score, you will must grasp a single line of credit score earlier than you develop to new horizons. It might take a yr to pay greater than the minimal requirement on time and keep away from racking the steadiness. Including a brand new line of credit score to the combo may doubtlessly enhance your prices, harm your present rating and complicate issues.

Automate Your Funds

One of the simplest ways to restrict your probabilities of lacking a cost is by establishing computerized funds. It is nearly crucial you probably have a number of due dates to recollect. You will have the choice to pay a customized quantity, pay the complete steadiness, or the minimal. You will must determine what works greatest to your finances, however in the event you’ve learn this far, you realize the choice is to attempt to pay in full. Paying off playing cards you do not use typically is crucial as a result of small balances can rapidly add up with fees on small purchases that you could be overlook about.

Improve Your Spending Restrict

If you wish to enhance your spending restrict to lower your credit score utilization, contemplate asking your present card to extend your spending restrict. You’ll be able to keep away from the chance and hassles of making use of for a brand new line of credit score.

Professionals & Cons of Opening A New Account

Professionals

- If you have already got credit score, you possibly can decrease your total credit score utilization ratio

- You’ll be able to construct your credit score quicker as a result of extra info is reported to main credit score bureaus every month

- You’ll be able to have entry to 0% financing or higher rewards You have got emergencies coated with extra credit score

- You’ll be able to reap the benefits of wonderful sign-up perks

Cons

- You’ll be able to enhance your debt to unsustainable ranges

- You’ll be able to harm your credit score quickly

- You’ll be able to have issue managing a number of due dates

Common Credit score Card Stability by State

Are you questioning how your state matches up with a line of credit score balances? This is who has the very best credit score balances.

State Common Credit score Card Stability Alabama $5,672 Alaska $8,026 Arizona $6,053 Arkansas $5,327 California $6,222 Colorado $6,416 Connecticut $7,082 Delaware $6,335 District of Columbia $7,077 Florida $6,460 Georgia $6,569 Hawaii $6,673 Idaho $5,213 Illinois $6,253 Indiana $5,254 Iowa $4,774 Kansas $5,769 Kentucky $5,140 Louisiana $5,811 Maine $5,44 2 Maryland $6,946 Massachusetts $6,213 Michigan $5,399 Minnesota $5,489 Mississippi $5,134 Missouri $5,601 Montana $5,482 Nebraska $5,423 Nevada $6,220 New Hampshire $6,235 >New Jersey $7,084 New Mexico $5,851 New York $6,491 North Carolina $5,832 North Dakota $5,265 Ohio $5,560 Oklahoma $5,848 Oregon $5,498 Pennsylvania $5,840 Rhode Island $6,177 South Carolina $5,938 South Dakota $5,235 Tennessee $5,688 Texas $6,753 Utah $5,600 Vermont $5,466 Virginia $6,969 Washington $6,156 West Virginia $5,144 Wisconsin $4,961 Wyoming $5,782

Are You In search of A Line of Credit score?

If in case you have been denied a line of credit score as a result of you’ve gotten a bad credit score or no credit score in any respect, you possibly can apply on-line.

There isn’t any one measurement suits all reply to what number of traces of credit score it’s best to have. The proper steadiness for you is dependent upon the necessities, your potential to pay them off, and the way you employ your line of credit score. Having two traces of credit score could possibly be too many if you cannot afford to make your funds or do not have plans to make use of it quickly.

A brand new line of credit score might enhance your credit score rating. Nevertheless, it’s best to by no means take out a further line of credit score except essential. Making use of for a number of traces of credit score in a brief interval will not be suggested, and having too many traces of credit score make you look dangerous to lenders.

How Many Traces of Credit score Do Individuals Have?

Whereas Individuals, on common, have practically 4 bank cards every, that is solely a nationwide common. FICO found that cardholders within the wonderful vary of credit score, scores 750 to 850, had three open accounts. That they had a complete of six traces of credit score in the event you embrace closed accounts.

New Jersey residents have a mean 3.49 bank cards.

New York residents have a mean 3.34 bank cards.

Rhode Island residents have a mean 3.26 bank cards.

Hawaii residents have a mean 3.25 bank cards.

California residents have a mean 3.23 bank cards.

Do Traces of Credit score Have an effect on Your Credit score Rating?

What number of traces of credit score you’ve gotten does not straight have an effect on your credit score rating. Extra vital than the variety of credit score traces you’ve gotten is whether or not you pay on time and what number of your obtainable credit score you employ. Most individuals with wonderful FICO scores, 795 or increased, would not have late funds on their credit score stories. Additionally they solely use 7% of their credit score restrict. If you happen to’re considering of opening or closing a revolving line of credit score, hold these in thoughts:

Your Cost Historical past

How a lot credit score you employ and your cost historical past decide 65% of your FICO rating. Paying your credit score traces on time is much extra vital than what number of traces of credit score you’ve gotten. If you wish to construct your credit score rating quick – pay your credit score payments on time.

Your Credit score Utilization

How a lot of the credit score restrict you employ, known as the credit score utilization ratio, accounts for one-third of your credit score rating. Retaining your ratio under 30% might help you maximize your credit score rating.

If you happen to open a brand new line of credit score and enhance your total credit score line, it may assist construct your credit score rating by reducing your credit score utilization. It is vital to know that making use of for a brand new line of credit score leads to a tough credit score inquiry which may quickly drop your rating a couple of factors. You will wish to keep away from making use of for a number of credit score traces; spacing purposes six months aside will stop quite a few laborious inquiries from affecting your rating.

Your Credit score Historical past

The age of your line of credit score is crucial. Lenders and collectors wish to see steady and lengthy credit score histories. However having one outdated line of credit score that was appropriately managed will not be sufficient.

Your credit score rating is the common of all of the traces of credit score that you’ve. A ding to your credit score could also be value it in the event you shut a line of credit score if you really feel the rate of interest is just too excessive or the service is horrible. It is at all times value speaking along with your lender to see your choices earlier than closing your credit score line.

Your New Credit score Accounts

Just lately opened credit score accounts calculate 10% of your credit score rating. The brand new credit score may be detrimental to you you probably have a brief credit score historical past. As talked about earlier than, it’s best to wait no less than six months earlier than opening one other.

Your Credit score Combine

One other 10% of your FICO® rating is your credit score combine or quantity of credit score traces. The credit score bureaus contemplate your number of traces of credit score, retail accounts, and bank cards. It is pointless to have every sort of credit score, however lenders wish to see you handle a various vary of credit score traces.

Is It Good to Have A number of Traces of Credit score?

Sure, you possibly can have a number of traces of credit score at one time. Most individuals have a number of at a time. If you happen to presently have bank cards, a mortgage, pupil loans, and so on., you’ve gotten multiple line of credit score. There are execs to having a number of so long as you retain up with all funds.

Professionals

Your FICO® rating determines the quantity and number of loans you possibly can handle without delay. This is without doubt one of the most generally used credit score scores, and having a number of traces of credit score can increase it. FICO sees the number of loans as expertise with borrowing cash. You will not profit from a number of traces of credit score in the event you do not sustain with funds, have a excessive credit score utilization charge, and use unhealthy credit score practices.

Cons

Though having multiple line of credit score may be useful, it comes with potential dangers. When you’ve gotten a number of loans, you’re including further curiosity to your month-to-month bills. If in case you have excessive rates of interest, it may change into difficult to fulfill all cost obligations on time.With a number of traces of credit score to repay, it’s simpler to overlook to pay a invoice. This might negatively influence your credit score rating and have an effect on your probabilities of getting a long-term or short-term mortgage.If you happen to take out too many traces of credit score, FICO may even see this as you being in monetary bother.

Handle A number of Traces of Credit score

While you wish to construct your credit score, it is best to have no less than two open traces of credit score. Preserve your oldest credit score line open, and it’s best to be capable to get an improve after making funds on time for six months. There are various methods to handle your credit score line, so listed below are eventualities for one, two, and three or extra traces of credit score.

One Line of Credit score

One credit score account is widespread, particularly in the event you’re beginning or constructing from any monetary errors. If in case you have extra established credit score, chances are you’ll select to have a single line of credit score to keep away from any temptation of overspending or forgetting to make a cost. The one challenge with having just one credit score line is that you could be be leaving financial savings on the desk.

Two Traces of Credit score

If you haven’t any debt along with your two credit score traces, you possibly can use a pair of reward playing cards. One may provide cashback rewards, and the opposite may provide you with journey rewards or reductions at your favourite retailer. If in case you have debt or are making ready to make a big buy that might take months to resolve, it’s best to use a rewards card for on a regular basis spending and a 0% card for financing.

Three or Extra Traces of Credit score

Having a 3rd credit score line means that you can be extra opportunistic with particular presents and choose and select the very best phrases. If you happen to plan on paying in full, you possibly can choose in for the very best rewards card to your most important month-to-month purchases. You should utilize two core playing cards and complement with the very best preliminary presents obtainable. You can additionally use a few rewards playing cards with a 0% APR provide. However keep in mind, the extra traces of credit score you’ve gotten, the extra you will must handle these monetary obligations.

Select the Proper Variety of Credit score Traces

Increase As Your Credit score Grows

An important issue figuring out what number of traces of credit score it’s best to have, or can have, is your expertise. You will must ask your self you probably have established credit score or are you beginning out? The much less skilled or, the more serious your credit score rating is, the less choices you will have and the extra you will must give attention to one credit score line and handle it responsibly.

Completely Handle Your One Card

If in case you have good or a bad credit score, you will must grasp a single line of credit score earlier than you develop to new horizons. It might take a yr to pay greater than the minimal requirement on time and keep away from racking the steadiness. Including a brand new line of credit score to the combo may doubtlessly enhance your prices, harm your present rating and complicate issues.

Automate Your Funds

One of the simplest ways to restrict your probabilities of lacking a cost is by establishing computerized funds. It is nearly crucial you probably have a number of due dates to recollect. You will have the choice to pay a customized quantity, pay the complete steadiness, or the minimal. You will must determine what works greatest to your finances, however in the event you’ve learn this far, you realize the choice is to attempt to pay in full. Paying off playing cards you do not use typically is crucial as a result of small balances can rapidly add up with fees on small purchases that you could be overlook about.

Improve Your Spending Restrict

If you wish to enhance your spending restrict to lower your credit score utilization, contemplate asking your present card to extend your spending restrict. You’ll be able to keep away from the chance and hassles of making use of for a brand new line of credit score.

Professionals & Cons of Opening A New Account

Professionals

- If you have already got credit score, you possibly can decrease your total credit score utilization ratio

- You’ll be able to construct your credit score quicker as a result of extra info is reported to main credit score bureaus every month

- You’ll be able to have entry to 0% financing or higher rewards You have got emergencies coated with extra credit score

- You’ll be able to reap the benefits of wonderful sign-up perks

Cons

- You’ll be able to enhance your debt to unsustainable ranges

- You’ll be able to harm your credit score quickly

- You’ll be able to have issue managing a number of due dates

Common Credit score Card Stability by State

Are you questioning how your state matches up with a line of credit score balances? This is who has the very best credit score balances.

State Common Credit score Card Stability Alabama $5,672 Alaska $8,026 Arizona $6,053 Arkansas $5,327 California $6,222 Colorado $6,416 Connecticut $7,082 Delaware $6,335 District of Columbia $7,077 Florida $6,460 Georgia $6,569 Hawaii $6,673 Idaho $5,213 Illinois $6,253 Indiana $5,254 Iowa $4,774 Kansas $5,769 Kentucky $5,140 Louisiana $5,811 Maine $5,44 2 Maryland $6,946 Massachusetts $6,213 Michigan $5,399 Minnesota $5,489 Mississippi $5,134 Missouri $5,601 Montana $5,482 Nebraska $5,423 Nevada $6,220 New Hampshire $6,235 >New Jersey $7,084 New Mexico $5,851 New York $6,491 North Carolina $5,832 North Dakota $5,265 Ohio $5,560 Oklahoma $5,848 Oregon $5,498 Pennsylvania $5,840 Rhode Island $6,177 South Carolina $5,938 South Dakota $5,235 Tennessee $5,688 Texas $6,753 Utah $5,600 Vermont $5,466 Virginia $6,969 Washington $6,156 West Virginia $5,144 Wisconsin $4,961 Wyoming $5,782

Are You In search of A Line of Credit score?

If in case you have been denied a line of credit score as a result of you’ve gotten a bad credit score or no credit score in any respect, you possibly can apply on-line.