So, you have a low credit score.

While you may feel embarrassed or even ashamed, the truth is, it happens to a lot of us.

Building and maintaining your credit score has never been more important. With the housing market unable to find a steady point of growth since the collapse in ’08, and the economy growing at its slowest pace in history, having readily available credit and the option to purchase larger ticket items for a lower interest rate is a must.

Whether you fell into a spot of bad financial luck or you just didn’t take the time to plan your finances, what happened in the past doesn’t matter. What you need to do now is figure out a way to move forward.

But many Americans assume their credit score is based on their past credit history and there’s nothing to do to change it. But the fact is, there are several different methods you can use to raise your credit score, even if your current credit score is bad or not so great.

If you have bad debts, those won’t last forever either. Though it may take up to 7 years depending on your state, they will fall off.

if you’re looking for ideas to up your credit score as soon as possible, we’ve got some easy tips for you to take advantage of.

Figure out Your Credit Usage

The first step to fixing up your low credit score is to determine exactly how much credit you use.

I know, I know. That sounds complicated. However, it’s very simple, and it’s essential to developing a proper budget that works.

Your credit usage is your ratio between what credit you have available (on all cards or accounts) and the amount you’ve used. Divide your balances by your credit limits and multiply it by 100.

Ideally, that number should be under 30%. However, if your credit is less than healthy, you can start taking other steps to fix it.

Pay Your Bills on Time

This seems like it’s a no-brainer, but there’s no time like the present to get to work on repairing your low credit score. The easiest way to do that is to make sure your bills are paid on time.

Paying your bills on time is key, especially while you’re in the process of fixing your low credit score. While you’re juggling and trying to keep up with all those payments that you fell behind on (or consciously stopped paying – it happens to the best of us), anything you fall behind on can ruin your progress.

By missing bill payments, your score will continue to drop. Even if you’ve figured your finances out and are sitting on a cash mountain, you could still miss out on opportunities for homes and vehicles.

When we say every bill, we mean every bill. Skipped a cable payment? Pay it up as soon as possible. It could go to collections (in extreme cases), which could be an additional ding on your credit report.

Use a Calendar

If you’re planning on making a big purchase in the future, you need to plan that out. Give it a short period of time, or else it may be noted on your credit report.

For every application for credit you take out, your credit score will dip slightly. This happens because, if you’re making multiple credit applications, there’s a pretty solid chance you want to use even more credit.

Sometimes, especially with big purchases like cars or house, they’ll account for the fact that you’ll likely use multiple applications, even if you only take out one loan.

Your FICO score will ignore applications made 30 days before the score was set, and any that are older than 30 days and made in a short amount of time as one inquiry.

Don’t Run from Your Old Debt

It can be scary having old debts on your credit report, especially if you’re hard at work taking steps to fix your low credit score. Nothing’s worse than applying for an apartment, home loan, or anything that requires a credit check while you know you have terrible debt that could’ve been avoided.

Just because you have something paid off doesn’t mean you need to fight to have it removed from your report. Of course, negative items will negatively affect your credit score.

However, there are some good things on your report that you’ll want to take advantage of. If your debt is handled well and paid on time, it will benefit your score the longer you keep it on there.

Therefore, you should keep your old debts and accounts on your report if you can. Additionally, consider keeping accounts open when you’ve had a good repayment record with them.

Get Rid of Credit Card Balances

Getting rid of your credit card balances is a fantastic way to improve your credit score with ease.

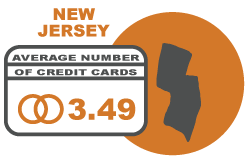

Of course, this only works if you have multiple credit cards open. The balances that are easiest to get rid of are those that are small, so if you have many small balances spread out between numerous cards, you’ll benefit the most from paying them off first.

A reason this helps is that your credit score takes into account how many cards you have open, and how many balances you have. This contributes to your overall credit usage, and can quickly lower your score if you’re not careful.

The easiest way to deal with it? Do just that: deal with it.

Take all the cards which you have balances on and just pay them off. If you can’t pay them off in one lump sum, don’t worry: pay them off as you can. Save the money and pay them off entirely.

After that, keep one or two cards that are in good standing. Go ahead and use those for emergencies only, or else you’ll risk getting caught up in the cycle of debt and destruction. That doesn’t pay, especially when you’re trying to improve that low credit score of yours.

Keep Track of Your Spending – It Will Improve Your Credit

Let’s start with the basics. The first and best thing you can do is keep track of your spending. Keep a budget and make sure you know about all the transactions that occur with your checking or savings account. It might surprise you to learn that up to 25 million households in the United States are living paycheck to paycheck, and a significant percentage of those do not keep track of their spending.

Even if your expenses are tight, it is in your best interest to check your spending against your bank statements to make sure you do not incur any unwanted or mistaken charges.

Most people think erroneous charges only happen in cases of identity theft, but there are many opportunities for incorrect charges to appear on your statement, and contribute to the possibility of an overdraft, which gets reported to the credit companies. For instance, if you buy an article of clothing from a small business using your credit card or debit card, it is not uncommon for those charges to mistakenly remain on your statement.

Small businesses generally don’t handle very many returns and are not well practiced in the process of reversing a charge to your card. This is just one example of why it’s always good to keep track of your spending.

Rebuild Your Credit by Not Exceeding Your Limit

Another basic tip is not to exceed your credit limits. Seems obvious, but many people will be close to their credit limit and incur a charge that puts them over the limit. This gets reported to the credit score companies and influences your score.

What Can You Do to Build Your Credit Score Fast?

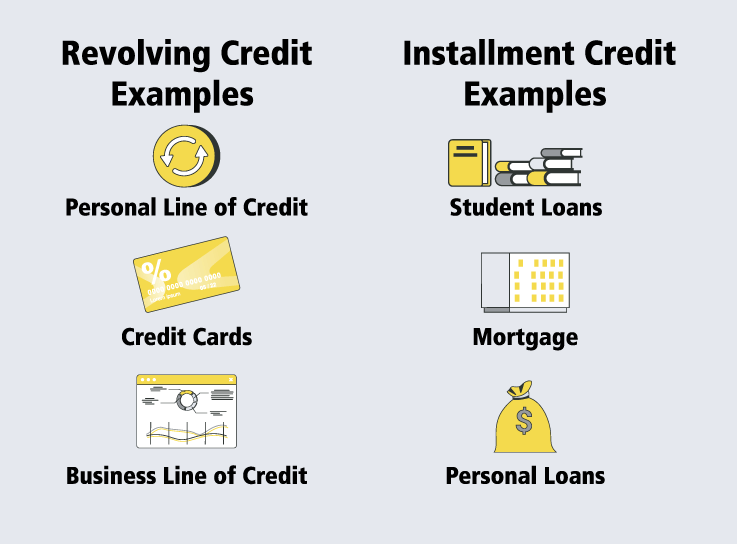

Pay off your balance every month. Perhaps you felt it’s better to simply pay for everything with a check or debit card and not incur charges on your credit card at all. That is perfectly valid, but you can build your credits score slowly and deliberately by charging a few things to your card and then paying it off every month.

Stop charging.

If you already have a card with a large balance on it, stop charging things to that card and begin eliminating your balance by making payments that exceed the minimum due. By reducing your balance, you can help build your credit score.

Don’t max out your card.

If you have a thousand-dollar limit on your card, don’t go above eight hundred in charges. It’s best, of course, to keep your balance at zero, but if you feel you must make a charge to your card, stay below the credit limit. This will help increase your credit score.

Pay your bill on time. Best to pay your bill as soon as it comes in, but of you can’t, at the very least make that payment by the due date. Late payments are always reported to the credit score companies and they can have a negative effect on your credit score.

Avoid store card accounts.

They tend to come with the highest interest rates and least benefits. Even if you shop at that store, use your own credit card for purchases. Of course, this is not the same as a buying club card, and you will want to be sure you know the difference. Buying club cards give you rewards for spending at their store, but it is not an actual charge account. Even if you are good with your store account, most stores don’t report your activity to the credit companies unless it’s for negative reasons. Fortunately, most stare charge accounts are being phased out and will soon become the product of a bygone era.

If you’ve had a credit card for six months to a year, consider asking for an increased line of credit. Even if you don’t use it, an increase in credit limit is a good sign to the credit score companies who will make a note of such on your report. Don’t be nervous about asking and don’t feel bad if you get turned down. This just means they don’t feel comfortable raising your credit limit yet. But here’s a tip: if you are turned down today, wait a month and call back again with the same request.

Credit card companies want to raise your credit to entice you to spend more. We recommend that you don’t, of course. Raising your credit limit looks good on your report, but if you charge that much to your card, then you are just hurting yourself. Ask for an increased limit and then don’t spend it. This helps increase your score.

Fix Your Low Credit Score Today!

Credit can be tricky to figure out, especially if you aren’t financially-minded. However, it’s important to keep your finances in order, or else you run the risk of your credit score crashing again.

The easiest ways to fix your credit score involve paying off your outstanding debts and making sure you continue to pay your bills on time. Simple stuff, really!

We hope you find these tips helpful. CASH 1 is interested in helping you out during difficult financial circumstances. If your credit is not so great, come see us about same day loans or Payday Loans in Las Vegas.

So, you have a low credit score.

While you may feel embarrassed or even ashamed, the truth is, it happens to a lot of us.

Building and maintaining your credit score has never been more important. With the housing market unable to find a steady point of growth since the collapse in ’08, and the economy growing at its slowest pace in history, having readily available credit and the option to purchase larger ticket items for a lower interest rate is a must.

Whether you fell into a spot of bad financial luck or you just didn’t take the time to plan your finances, what happened in the past doesn’t matter. What you need to do now is figure out a way to move forward.

But many Americans assume their credit score is based on their past credit history and there’s nothing to do to change it. But the fact is, there are several different methods you can use to raise your credit score, even if your current credit score is bad or not so great.

If you have bad debts, those won’t last forever either. Though it may take up to 7 years depending on your state, they will fall off.

if you’re looking for ideas to up your credit score as soon as possible, we’ve got some easy tips for you to take advantage of.

Figure out Your Credit Usage

The first step to fixing up your low credit score is to determine exactly how much credit you use.

I know, I know. That sounds complicated. However, it’s very simple, and it’s essential to developing a proper budget that works.

Your credit usage is your ratio between what credit you have available (on all cards or accounts) and the amount you’ve used. Divide your balances by your credit limits and multiply it by 100.

Ideally, that number should be under 30%. However, if your credit is less than healthy, you can start taking other steps to fix it.

Pay Your Bills on Time

This seems like it’s a no-brainer, but there’s no time like the present to get to work on repairing your low credit score. The easiest way to do that is to make sure your bills are paid on time.

Paying your bills on time is key, especially while you’re in the process of fixing your low credit score. While you’re juggling and trying to keep up with all those payments that you fell behind on (or consciously stopped paying – it happens to the best of us), anything you fall behind on can ruin your progress.

By missing bill payments, your score will continue to drop. Even if you’ve figured your finances out and are sitting on a cash mountain, you could still miss out on opportunities for homes and vehicles.

When we say every bill, we mean every bill. Skipped a cable payment? Pay it up as soon as possible. It could go to collections (in extreme cases), which could be an additional ding on your credit report.

Use a Calendar

If you’re planning on making a big purchase in the future, you need to plan that out. Give it a short period of time, or else it may be noted on your credit report.

For every application for credit you take out, your credit score will dip slightly. This happens because, if you’re making multiple credit applications, there’s a pretty solid chance you want to use even more credit.

Sometimes, especially with big purchases like cars or house, they’ll account for the fact that you’ll likely use multiple applications, even if you only take out one loan.

Your FICO score will ignore applications made 30 days before the score was set, and any that are older than 30 days and made in a short amount of time as one inquiry.

Don’t Run from Your Old Debt

It can be scary having old debts on your credit report, especially if you’re hard at work taking steps to fix your low credit score. Nothing’s worse than applying for an apartment, home loan, or anything that requires a credit check while you know you have terrible debt that could’ve been avoided.

Just because you have something paid off doesn’t mean you need to fight to have it removed from your report. Of course, negative items will negatively affect your credit score.

However, there are some good things on your report that you’ll want to take advantage of. If your debt is handled well and paid on time, it will benefit your score the longer you keep it on there.

Therefore, you should keep your old debts and accounts on your report if you can. Additionally, consider keeping accounts open when you’ve had a good repayment record with them.

Get Rid of Credit Card Balances

Getting rid of your credit card balances is a fantastic way to improve your credit score with ease.

Of course, this only works if you have multiple credit cards open. The balances that are easiest to get rid of are those that are small, so if you have many small balances spread out between numerous cards, you’ll benefit the most from paying them off first.

A reason this helps is that your credit score takes into account how many cards you have open, and how many balances you have. This contributes to your overall credit usage, and can quickly lower your score if you’re not careful.

The easiest way to deal with it? Do just that: deal with it.

Take all the cards which you have balances on and just pay them off. If you can’t pay them off in one lump sum, don’t worry: pay them off as you can. Save the money and pay them off entirely.

After that, keep one or two cards that are in good standing. Go ahead and use those for emergencies only, or else you’ll risk getting caught up in the cycle of debt and destruction. That doesn’t pay, especially when you’re trying to improve that low credit score of yours.

Keep Track of Your Spending – It Will Improve Your Credit

Let’s start with the basics. The first and best thing you can do is keep track of your spending. Keep a budget and make sure you know about all the transactions that occur with your checking or savings account. It might surprise you to learn that up to 25 million households in the United States are living paycheck to paycheck, and a significant percentage of those do not keep track of their spending.

Even if your expenses are tight, it is in your best interest to check your spending against your bank statements to make sure you do not incur any unwanted or mistaken charges.

Most people think erroneous charges only happen in cases of identity theft, but there are many opportunities for incorrect charges to appear on your statement, and contribute to the possibility of an overdraft, which gets reported to the credit companies. For instance, if you buy an article of clothing from a small business using your credit card or debit card, it is not uncommon for those charges to mistakenly remain on your statement.

Small businesses generally don’t handle very many returns and are not well practiced in the process of reversing a charge to your card. This is just one example of why it’s always good to keep track of your spending.

Rebuild Your Credit by Not Exceeding Your Limit

Another basic tip is not to exceed your credit limits. Seems obvious, but many people will be close to their credit limit and incur a charge that puts them over the limit. This gets reported to the credit score companies and influences your score.

What Can You Do to Build Your Credit Score Fast?

Pay off your balance every month. Perhaps you felt it’s better to simply pay for everything with a check or debit card and not incur charges on your credit card at all. That is perfectly valid, but you can build your credits score slowly and deliberately by charging a few things to your card and then paying it off every month.

Stop charging.

If you already have a card with a large balance on it, stop charging things to that card and begin eliminating your balance by making payments that exceed the minimum due. By reducing your balance, you can help build your credit score.

Don’t max out your card.

If you have a thousand-dollar limit on your card, don’t go above eight hundred in charges. It’s best, of course, to keep your balance at zero, but if you feel you must make a charge to your card, stay below the credit limit. This will help increase your credit score.

Pay your bill on time. Best to pay your bill as soon as it comes in, but of you can’t, at the very least make that payment by the due date. Late payments are always reported to the credit score companies and they can have a negative effect on your credit score.

Avoid store card accounts.

They tend to come with the highest interest rates and least benefits. Even if you shop at that store, use your own credit card for purchases. Of course, this is not the same as a buying club card, and you will want to be sure you know the difference. Buying club cards give you rewards for spending at their store, but it is not an actual charge account. Even if you are good with your store account, most stores don’t report your activity to the credit companies unless it’s for negative reasons. Fortunately, most stare charge accounts are being phased out and will soon become the product of a bygone era.

If you’ve had a credit card for six months to a year, consider asking for an increased line of credit. Even if you don’t use it, an increase in credit limit is a good sign to the credit score companies who will make a note of such on your report. Don’t be nervous about asking and don’t feel bad if you get turned down. This just means they don’t feel comfortable raising your credit limit yet. But here’s a tip: if you are turned down today, wait a month and call back again with the same request.

Credit card companies want to raise your credit to entice you to spend more. We recommend that you don’t, of course. Raising your credit limit looks good on your report, but if you charge that much to your card, then you are just hurting yourself. Ask for an increased limit and then don’t spend it. This helps increase your score.

Fix Your Low Credit Score Today!

Credit can be tricky to figure out, especially if you aren’t financially-minded. However, it’s important to keep your finances in order, or else you run the risk of your credit score crashing again.

The easiest ways to fix your credit score involve paying off your outstanding debts and making sure you continue to pay your bills on time. Simple stuff, really!

We hope you find these tips helpful. CASH 1 is interested in helping you out during difficult financial circumstances. If your credit is not so great, come see us about same day loans or Payday Loans in Las Vegas.