Mutual funds remind us of the ads on tv. The sentence that claims, ‘mutual funds are topic to market dangers.’ This threat issue typically confuses us whether or not to spend money on it or not. You might want to know totally different features and varieties of mutual funds to grasp their advantages.

Right here’s a whole information on the best way to spend money on mutual funds!

What are mutual funds?

It’s a professionally managed funding fund that collects buyers’ cash to buy securities. It’s created when an asset administration firm (AMC) collects investments with the identical targets. The fund supervisor manages these investments. The fund supervisor strategically invests in securities to generate most returns.

Fund managers are individuals with a superb observe report of managing investments. They’ve an in-depth understanding of the market. They take annual expenses for managing your investments.

The mutual fund buyers achieve returns by way of common dividends or curiosity and capital appreciation. They will use this return in two methods. They will both use the expansion possibility and reinvest the cash, or they will use the dividend choice to make it a supply of regular revenue.

Forms of mutual funds

There are three principal varieties of mutual funds. They’re as follows-

Mutual funds primarily based on asset class

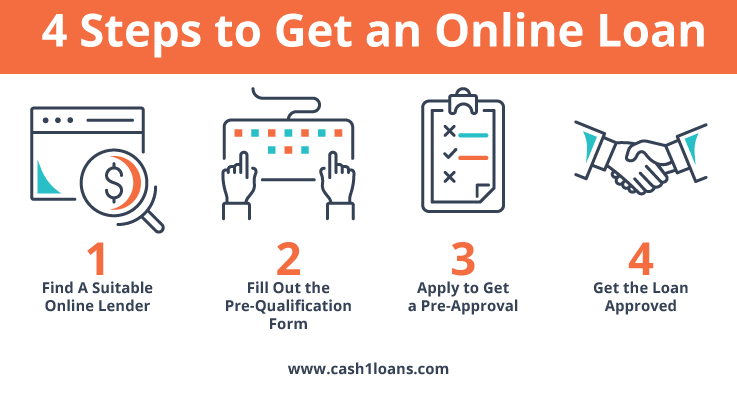

One can spend money on Mutual Funds by submitting a duly accomplished software type together with a cheque or financial institution draft

One can spend money on Mutual Funds by submitting a duly accomplished software type together with a cheque or financial institution draft

There are three asset lessons in mutual funds. They’re the debit funds, fairness funds, and hybrid funds. Let’s know extra about them-

- Debit funds- They’re often known as fixed-income funds. They spend money on belongings like authorities securities, company bonds, and cash market devices. They provide common returns to the buyers and are identified to be secure.

- Fairness funds- These funds make investments a major portion of your cash in shares. The principle goal of those funds is capital appreciation. The returns on fairness funds are linked to market fluctuations. That’s why they’re thought-about to be dangerous. But, they could be a sensible choice for long-term investments.

- Hybrid funds- If you wish to get a center floor, then these are the funds for you. They provide you fairness and debt in investments. These funds are categorized into six varieties primarily based on their asset allocation. They’re as follows-

No.

Hybrid funds

Debt devices

Fairness 1 Conservative hybrid fund 75-90% 10-25% 2 Balanced hybrid fund 40-60% 40-60% 3 Aggressive hybrid fund 20-35% 65-80% 4 Fairness financial savings fund 10% 65% 5 Multi-asset allocation fund 10% 10% 6 Arbitrage fund – 65%

Mutual funds primarily based on construction

With compound curiosity, your funding will probably develop in worth over time. Use our funding calculator to see how a lot your funding could possibly be value

With compound curiosity, your funding will probably develop in worth over time. Use our funding calculator to see how a lot your funding could possibly be value

These mutual funds even have three varieties. They’re as follows-

- Open-funded mutual fund- Identical to the identify suggests, it’s the type of mutual fund the place you possibly can make investments at any time. They’ve a Web Asset Worth (NAV). They could be a good liquid fund possibility that you need to use to promote or redeem fund models.

- Shut-ended mutual fund- This type of fund comes with a maturity date. You possibly can make investments on this fund solely when they’re launched. You possibly can withdraw this cash solely after the maturity date.

- Interval funds- It incorporates qualities of each open and close-ended funds. Interval funds don’t permit buyers to purchase or promote models. They spend money on each debt and fairness securities.

Learn extra: A complete information to funding banking programs

Mutual funds primarily based on funding targets

These mutual funds are categorised primarily based on their targets into 4 classes.

- Development funds- The principle goal of this fund is capital appreciation. They make investments a big quantity of your cash in inventory and development sectors. They’re identified to be dangerous.

- Earnings funds- These funds provide common revenue to the buyers. They’re debt funds that spend money on bonds, debentures, industrial papers, authorities securities, and certificates of deposit.

- Liquid funds- They supply liquidity to the buyers. They put cash within the short-term cash market instrument. They’re a terrific possibility if you wish to create emergency funds.

- Tax-saving funds- These funds provide tax advantages. After investing on this fund, you possibly can declare a deduction of the funds as much as INR 1.5 lakhs. They could be a good possibility for major funding objectives.

Easy methods to spend money on mutual funds?

Step one to investing in mutual funds is KYC (Know Your Buyer). It is a time period used for buyer identification. To develop into KYC grievance, you want the next documents-

- Latest passport-size picture

- PAN card

- Adhar card

- KYC type

After changing into a KYC grievance, you possibly can spend money on mutual funds. There are a number of methods by which you’ll be able to make investments.

By distributor

Funds distributor is an individual who has the authority that will help you with mutual funds investments. They’re registered with the Affiliation of Mutual Funds India (AMFI). When you purchase mutual funds models by way of a distributor, they may have the next worth than immediately bought models from AMC. The fund distributors don’t cost charges from buyers.

Direct buy by AMC

The Annual Upkeep Contract (AMC) is made for the acquisition of mutual funds models. You possibly can go to the workplace or their web site for it. You simply have to submit KYC paperwork and select your funding plans.

- Registered Funding Adviser (RIA)

These are SEBI registered advisers. They don’t obtain any fee from AMC, however they will cost the buyers for his or her funding recommendation.

- Registrars and Switch Brokers (RTA)

These brokers course of mutual funds transactions on behalf of the fund home. You possibly can go to the workplace or their on-line portal for extra info.

Key takeaways

- Earlier than investing in mutual funds, it’s important to research the dangers and advantages of the investments.

- Mutual funds have a number of varieties. You might want to decide your goal of funding earlier than making the choice.

- KYC is a should for making mutual funds investments.

Hope you discover this info useful. Write us your helpful suggestions. Click on right here to learn extra such articles.