You’ll qualify for a private mortgage if in case you have a very good credit score rating and a good earnings. Nevertheless, one other concern is getting your mortgage authorized with low or unsteady income. Many lenders have a minimal earnings requirement coverage, whereas others might require you to signal your property as collateral to ensure you repay the quantity. Although getting a private mortgage with a low earnings could be difficult, it is not unimaginable. You may nonetheless discover choices for those who’re struggling financially and have little income.

APPLY NOW

What Is a Low Earnings Mortgage?

Low earnings loans are private loans or different financing choices for these thought of low earnings, relying on components past your pay. Lenders will decide your month-to-month earnings in response to the scale of your loved ones and your present bills.

Low earnings might not at all times imply your mortgage utility will get rejected. However, for those who fall into the decrease earnings class, you could not qualify for the mortgage quantities you need — or the most effective phrases and rates of interest. Keep in mind that you will not be charged the next rate of interest due to your low earnings; the first indicator is your credit score profile, also referred to as credit score historical past.

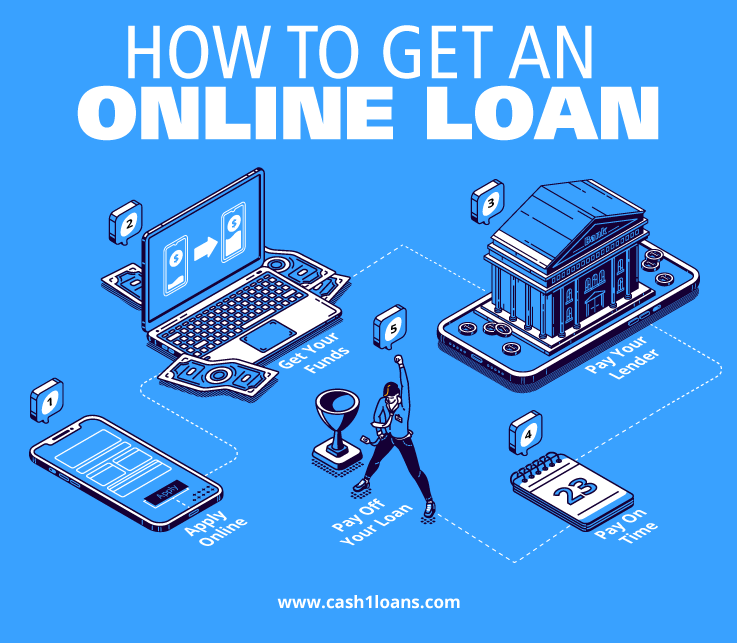

How Do Loans for Folks With Low Earnings Work?

In comparison with the opposite sorts of loans accessible out there, private loans are the most typical. Unsecured private loans even have the shortest processing time, which is useful for individuals who urgently want money.

One in all many important deciding components for private loans is your disposable earnings, which ought to be about 30-40% of your complete month-to-month earnings. Totally different lenders may have different eligibility standards, so you need to take a look at each lender’s necessities to seek out probably the most favorable compensation phrases.

Study These Phrases When Contemplating a Low Earnings Mortgage

If you’re looking for a mortgage and have a low earnings, needless to say lenders will study your capacity to repay your mortgage. Your debt-to-income (DTI) ratio is commonly used to find out this. Listed here are phrases and options to look over when researching getting your mortgage.

Earnings qualification

Some lenders restrict their danger by limiting the DTI ranges to 25% of your gross earnings. To accommodate for decrease earnings, lenders might improve that restrict to 30% or 40%. Researching every mortgage to know for those who qualify is at all times a good suggestion.

Mortgage quantity

Minimal mortgage necessities which are too excessive may stop you from qualifying. For instance, if a lender units the minimal mortgage quantity to $30,000, your earnings might solely assist a $20,000 mortgage.

Charges

Pay shut consideration to rates of interest. By having a decrease earnings, you might be able to make the most of the higher charges usually provided.

Size of mortgage

Negotiating an extended compensation time period will scale back your minimal month-to-month fee.

Direct help

Some federal and state packages present grants and funds for a down fee. When you qualify, you’ll be able to scale back the quantity you should borrow and your month-to-month funds.

Ensures

Chances are you’ll be required to supply extra ensures to repay your mortgage. It may embrace a co-signer that agrees to pay again your mortgage for those who fall behind in your funds. When you apply for an FHA or VA, or comparable government-backed mortgage, the federal authorities will present ensures to the lender.

Necessities for Low Earnings Loans

Low-income loans have the identical guidelines and tips as each different mortgage however with a lot larger stakes. Listed here are the fundamental necessities for a low-income mortgage:

- Some lenders would require you to have a sure earnings. Others might ask you to supply proof of earnings to simply accept your mortgage utility. Examine the necessities of particular person lenders fastidiously earlier than making use of.

- Credit score scores additionally matter for low-income loans. The minimal credit score rating necessities and insurance policies differ from lender to lender. You’ll be eligible provided that you fulfill these standards.

- Weak credit historical past can lead to your utility getting rejected. You will need to have a good credit score historical past to use for any mortgage, if not a pristine one.

- When you have a number of facet jobs, you’ll be able to examine with the lenders to see if that is eligible to be counted underneath your month-to-month earnings.

- Lenders usually have a debt-to-income ratio of 36%. For low-income loans, the identical restrictions apply. It might range with some lenders, however having too many money owed will jeopardize your mortgage utility.

APPLY NOW

What Are the Mortgage Choices Out there for Low Earnings Households?

Discovering appropriate mortgage choices for low-income households generally is a daunting job. Lenders might hesitate to simply accept your mortgage utility if in case you have a household that financially depends upon you. You usually tend to get accepted for a low-income mortgage if there are a number of breadwinners in a household since you’re thought of a low-risk applicant.

Different mortgage choices exist for low-income households that do not have high-interest charges. The next are a number of the most fitted mortgage choices for low-income households:

Secured private loans

With secured private loans, lenders require you to log off your property as collateral, that means for those who default, they’ll seize your property as compensation. The collateral could possibly be something; a automobile, your home, and even your financial savings accounts. These loans are simpler to be authorized by lenders, as they are going to nonetheless be capable to gather the compensation out of your property. They do not at all times require a very good credit score rating, both.

Unsecured private loans

With unsecured loans, you do not have to ensure any asset as collateral. Nevertheless, you could be charged the next rate of interest than typical if in case you have a weak credit rating. Some lenders even have minimal earnings necessities that you will have to meet.

Small, unsecured private loans

Most small unsecured private loans have a most quantity of $3,000. The rates of interest, mortgage phrases, and month-to-month funds will rely totally in your credit score profile and earnings.

PAL or payday various loans

If you’re a federal credit score union member, ask them if you may get another payday mortgage. Payday various loans have low utility charges, with the compensation interval starting from one to 12 months. The rates of interest are capped at 28%, and the utmost mortgage quantity for a PAL is $2,000.

How Can I Qualify for a Private Mortgage With Low Earnings?

The lender considers numerous components whereas they examine your mortgage utility type. Your earnings could possibly be a deal-breaker, however lenders additionally assess your credit score rating, credit score historical past, and bills to resolve whether or not you may be a credit score danger. Listed here are some suggestions that can assist you qualify for a private mortgage with a low earnings:

Preserve a low debt-to-income ratio

When you have a number of ongoing debt, fully repaying them is advisable earlier than requesting one other mortgage. The much less debt you might have, the better it’s so that you can get accepted.

When you have a number of ongoing debt, fully repaying them is advisable earlier than requesting one other mortgage. The much less debt you might have, the better it’s so that you can get accepted.

Examine for credit score errors

Although uncommon, errors in a credit score report may nonetheless be a difficulty. Earlier than making use of for a mortgage, examine your credit score historical past to make sure all the things is okay. When you discover something uncommon or assume the knowledge is wrong, report it to your lenders instantly. A clear credit score historical past might help you qualify for low-income loans even with weak credit scores.

Although uncommon, errors in a credit score report may nonetheless be a difficulty. Earlier than making use of for a mortgage, examine your credit score historical past to make sure all the things is okay. When you discover something uncommon or assume the knowledge is wrong, report it to your lenders instantly. A clear credit score historical past might help you qualify for low-income loans even with weak credit scores.

Checklist all earnings sources

Some lenders depend your month-to-month wage with facet gigs, freelancing, and different earnings. Ask your lender if they are going to contemplate doing the identical for you. Having a couple of earnings supply might help you negotiate higher phrases.

Some lenders depend your month-to-month wage with facet gigs, freelancing, and different earnings. Ask your lender if they are going to contemplate doing the identical for you. Having a couple of earnings supply might help you negotiate higher phrases.

Contemplate a co-signer

With a co-signed mortgage, you’ll be able to ask somebody with a greater credit score rating and earnings to use for a mortgage. The co-signer is legally sure to repay the debt in case you are not in a position to make the funds. The mortgage can even be recorded of their credit score historical past, affecting their credit score rating.

With a co-signed mortgage, you’ll be able to ask somebody with a greater credit score rating and earnings to use for a mortgage. The co-signer is legally sure to repay the debt in case you are not in a position to make the funds. The mortgage can even be recorded of their credit score historical past, affecting their credit score rating.

Get a smaller mortgage quantity

Small mortgage quantities imply much less danger to the lenders. Your mortgage utility is extra prone to get accepted for those who request a small quantity. The much less cash you borrow may result in decrease month-to-month repayments.

Small mortgage quantities imply much less danger to the lenders. Your mortgage utility is extra prone to get accepted for those who request a small quantity. The much less cash you borrow may result in decrease month-to-month repayments.

Are There Any Alternate options for Low Earnings Loans?

When you aren’t in a position to afford a low-income mortgage or do not qualify for one, then there are different choices accessible that may get you a mortgage, even with a low earnings.

Title loans

Like a mortgage, a title mortgage means that you can get a mortgage in opposition to your automobile title. To get your car’s title again, you could repay the debt in full by the deadline, or the lenders will seize your automobile as collateral. The car would not have to be a automobile. It may be a bike, boat, or perhaps a leisure car. You may apply for a mortgage if in case you have a legitimate license and paperwork for the car.

Bank cards

You may qualify for a bank card utility even with a low earnings. You should have a low credit score restrict, however it’s nonetheless an choice. Examine with lenders if they’ve any minimal earnings necessities.

Household & mates

This can be a no-brainer, and you will not be pressured to pay an outrageous processing price or rates of interest. When you have shut mates or household that you simply assume will probably be ready that can assist you out, borrowing from them will most likely prevent cash.

Money advance

Bank card issuers additionally provide a money advance mortgage. While you take out a money advance mortgage, you borrow the quantity in opposition to your bank card. You’ll have to pay a price for a money advance mortgage, and the rates of interest could be steep.

Payday loans

Payday loans cost you the next rate of interest, and you should repay the mortgage earlier than your subsequent paycheck, which suggests you might have about 2 to 4 weeks to repay the mortgage. Payday loans are tough to repay, however for those who can deal with the associated fee and quick deadline, you’ll be able to contemplate making use of for them.

APPLY NOW

The Backside Line

Getting any mortgage utility authorized by lenders may be difficult if you end up strapped for money and do not make sufficient cash. Nevertheless, there are alternatives to get a mortgage, particularly for low-income households and people. Generally the phrases and circumstances is probably not supreme for such loans, however they’re price contemplating. We hope this helps you perceive your choices and put together your self accordingly.

You’ll qualify for a private mortgage if in case you have a very good credit score rating and a good earnings. Nevertheless, one other concern is getting your mortgage authorized with low or unsteady income. Many lenders have a minimal earnings requirement coverage, whereas others might require you to signal your property as collateral to ensure you repay the quantity. Although getting a private mortgage with a low earnings could be difficult, it is not unimaginable. You may nonetheless discover choices for those who’re struggling financially and have little income.

APPLY NOW

What Is a Low Earnings Mortgage?

Low earnings loans are private loans or different financing choices for these thought of low earnings, relying on components past your pay. Lenders will decide your month-to-month earnings in response to the scale of your loved ones and your present bills.

Low earnings might not at all times imply your mortgage utility will get rejected. However, for those who fall into the decrease earnings class, you could not qualify for the mortgage quantities you need — or the most effective phrases and rates of interest. Keep in mind that you will not be charged the next rate of interest due to your low earnings; the first indicator is your credit score profile, also referred to as credit score historical past.

How Do Loans for Folks With Low Earnings Work?

In comparison with the opposite sorts of loans accessible out there, private loans are the most typical. Unsecured private loans even have the shortest processing time, which is useful for individuals who urgently want money.

One in all many important deciding components for private loans is your disposable earnings, which ought to be about 30-40% of your complete month-to-month earnings. Totally different lenders may have different eligibility standards, so you need to take a look at each lender’s necessities to seek out probably the most favorable compensation phrases.

Study These Phrases When Contemplating a Low Earnings Mortgage

If you’re looking for a mortgage and have a low earnings, needless to say lenders will study your capacity to repay your mortgage. Your debt-to-income (DTI) ratio is commonly used to find out this. Listed here are phrases and options to look over when researching getting your mortgage.

Earnings qualification

Some lenders restrict their danger by limiting the DTI ranges to 25% of your gross earnings. To accommodate for decrease earnings, lenders might improve that restrict to 30% or 40%. Researching every mortgage to know for those who qualify is at all times a good suggestion.

Mortgage quantity

Minimal mortgage necessities which are too excessive may stop you from qualifying. For instance, if a lender units the minimal mortgage quantity to $30,000, your earnings might solely assist a $20,000 mortgage.

Charges

Pay shut consideration to rates of interest. By having a decrease earnings, you might be able to make the most of the higher charges usually provided.

Size of mortgage

Negotiating an extended compensation time period will scale back your minimal month-to-month fee.

Direct help

Some federal and state packages present grants and funds for a down fee. When you qualify, you’ll be able to scale back the quantity you should borrow and your month-to-month funds.

Ensures

Chances are you’ll be required to supply extra ensures to repay your mortgage. It may embrace a co-signer that agrees to pay again your mortgage for those who fall behind in your funds. When you apply for an FHA or VA, or comparable government-backed mortgage, the federal authorities will present ensures to the lender.

Necessities for Low Earnings Loans

Low-income loans have the identical guidelines and tips as each different mortgage however with a lot larger stakes. Listed here are the fundamental necessities for a low-income mortgage:

- Some lenders would require you to have a sure earnings. Others might ask you to supply proof of earnings to simply accept your mortgage utility. Examine the necessities of particular person lenders fastidiously earlier than making use of.

- Credit score scores additionally matter for low-income loans. The minimal credit score rating necessities and insurance policies differ from lender to lender. You’ll be eligible provided that you fulfill these standards.

- Weak credit historical past can lead to your utility getting rejected. You will need to have a good credit score historical past to use for any mortgage, if not a pristine one.

- When you have a number of facet jobs, you’ll be able to examine with the lenders to see if that is eligible to be counted underneath your month-to-month earnings.

- Lenders usually have a debt-to-income ratio of 36%. For low-income loans, the identical restrictions apply. It might range with some lenders, however having too many money owed will jeopardize your mortgage utility.

APPLY NOW

What Are the Mortgage Choices Out there for Low Earnings Households?

Discovering appropriate mortgage choices for low-income households generally is a daunting job. Lenders might hesitate to simply accept your mortgage utility if in case you have a household that financially depends upon you. You usually tend to get accepted for a low-income mortgage if there are a number of breadwinners in a household since you’re thought of a low-risk applicant.

Different mortgage choices exist for low-income households that do not have high-interest charges. The next are a number of the most fitted mortgage choices for low-income households:

Secured private loans

With secured private loans, lenders require you to log off your property as collateral, that means for those who default, they’ll seize your property as compensation. The collateral could possibly be something; a automobile, your home, and even your financial savings accounts. These loans are simpler to be authorized by lenders, as they are going to nonetheless be capable to gather the compensation out of your property. They do not at all times require a very good credit score rating, both.

Unsecured private loans

With unsecured loans, you do not have to ensure any asset as collateral. Nevertheless, you could be charged the next rate of interest than typical if in case you have a weak credit rating. Some lenders even have minimal earnings necessities that you will have to meet.

Small, unsecured private loans

Most small unsecured private loans have a most quantity of $3,000. The rates of interest, mortgage phrases, and month-to-month funds will rely totally in your credit score profile and earnings.

PAL or payday various loans

If you’re a federal credit score union member, ask them if you may get another payday mortgage. Payday various loans have low utility charges, with the compensation interval starting from one to 12 months. The rates of interest are capped at 28%, and the utmost mortgage quantity for a PAL is $2,000.

How Can I Qualify for a Private Mortgage With Low Earnings?

The lender considers numerous components whereas they examine your mortgage utility type. Your earnings could possibly be a deal-breaker, however lenders additionally assess your credit score rating, credit score historical past, and bills to resolve whether or not you may be a credit score danger. Listed here are some suggestions that can assist you qualify for a private mortgage with a low earnings:

Preserve a low debt-to-income ratio

When you have a number of ongoing debt, fully repaying them is advisable earlier than requesting one other mortgage. The much less debt you might have, the better it’s so that you can get accepted.

When you have a number of ongoing debt, fully repaying them is advisable earlier than requesting one other mortgage. The much less debt you might have, the better it’s so that you can get accepted.

Examine for credit score errors

Although uncommon, errors in a credit score report may nonetheless be a difficulty. Earlier than making use of for a mortgage, examine your credit score historical past to make sure all the things is okay. When you discover something uncommon or assume the knowledge is wrong, report it to your lenders instantly. A clear credit score historical past might help you qualify for low-income loans even with weak credit scores.

Although uncommon, errors in a credit score report may nonetheless be a difficulty. Earlier than making use of for a mortgage, examine your credit score historical past to make sure all the things is okay. When you discover something uncommon or assume the knowledge is wrong, report it to your lenders instantly. A clear credit score historical past might help you qualify for low-income loans even with weak credit scores.

Checklist all earnings sources

Some lenders depend your month-to-month wage with facet gigs, freelancing, and different earnings. Ask your lender if they are going to contemplate doing the identical for you. Having a couple of earnings supply might help you negotiate higher phrases.

Some lenders depend your month-to-month wage with facet gigs, freelancing, and different earnings. Ask your lender if they are going to contemplate doing the identical for you. Having a couple of earnings supply might help you negotiate higher phrases.

Contemplate a co-signer

With a co-signed mortgage, you’ll be able to ask somebody with a greater credit score rating and earnings to use for a mortgage. The co-signer is legally sure to repay the debt in case you are not in a position to make the funds. The mortgage can even be recorded of their credit score historical past, affecting their credit score rating.

With a co-signed mortgage, you’ll be able to ask somebody with a greater credit score rating and earnings to use for a mortgage. The co-signer is legally sure to repay the debt in case you are not in a position to make the funds. The mortgage can even be recorded of their credit score historical past, affecting their credit score rating.

Get a smaller mortgage quantity

Small mortgage quantities imply much less danger to the lenders. Your mortgage utility is extra prone to get accepted for those who request a small quantity. The much less cash you borrow may result in decrease month-to-month repayments.

Small mortgage quantities imply much less danger to the lenders. Your mortgage utility is extra prone to get accepted for those who request a small quantity. The much less cash you borrow may result in decrease month-to-month repayments.

Are There Any Alternate options for Low Earnings Loans?

When you aren’t in a position to afford a low-income mortgage or do not qualify for one, then there are different choices accessible that may get you a mortgage, even with a low earnings.

Title loans

Like a mortgage, a title mortgage means that you can get a mortgage in opposition to your automobile title. To get your car’s title again, you could repay the debt in full by the deadline, or the lenders will seize your automobile as collateral. The car would not have to be a automobile. It may be a bike, boat, or perhaps a leisure car. You may apply for a mortgage if in case you have a legitimate license and paperwork for the car.

Bank cards

You may qualify for a bank card utility even with a low earnings. You should have a low credit score restrict, however it’s nonetheless an choice. Examine with lenders if they’ve any minimal earnings necessities.

Household & mates

This can be a no-brainer, and you will not be pressured to pay an outrageous processing price or rates of interest. When you have shut mates or household that you simply assume will probably be ready that can assist you out, borrowing from them will most likely prevent cash.

Money advance

Bank card issuers additionally provide a money advance mortgage. While you take out a money advance mortgage, you borrow the quantity in opposition to your bank card. You’ll have to pay a price for a money advance mortgage, and the rates of interest could be steep.

Payday loans

Payday loans cost you the next rate of interest, and you should repay the mortgage earlier than your subsequent paycheck, which suggests you might have about 2 to 4 weeks to repay the mortgage. Payday loans are tough to repay, however for those who can deal with the associated fee and quick deadline, you’ll be able to contemplate making use of for them.

APPLY NOW

The Backside Line

Getting any mortgage utility authorized by lenders may be difficult if you end up strapped for money and do not make sufficient cash. Nevertheless, there are alternatives to get a mortgage, particularly for low-income households and people. Generally the phrases and circumstances is probably not supreme for such loans, however they’re price contemplating. We hope this helps you perceive your choices and put together your self accordingly.